The economic group behind Insurance General, AFP Atlantic and Atlantic bank has transformed his vision into a financial ecosystem and insurer with strong presence in Dominican Republic.

His commitment to labor formalization, pension education and democratization of financial services has allowed these entities to grow quickly in recent years, but also with a human approach.

The senior executives of Insurance General, Atlantic bank and AFP Atlantic They talked to Diario Libre about their business prospects in the coming years.

The three entities share a client -centered philosophy, innovation and sustainability. Through a robust corporate governance, strict regulatory compliance and educational approach, the group has managed to connect with a client base that seeks closeness, confidence and custom solutions.

Facing the future, Insurance General, AFP Atlantic and Atlantic bank They are committed to grow responsible, expanding their value offer and contributing to the strengthening of the financial and pension system of the Dominican Republic.

Atlantic bank is consolidated in the market

He Atlantic bank savings and credit closed 2024 with Financial results positive, consolidating as one of the entities of the highest sector growth In the country.

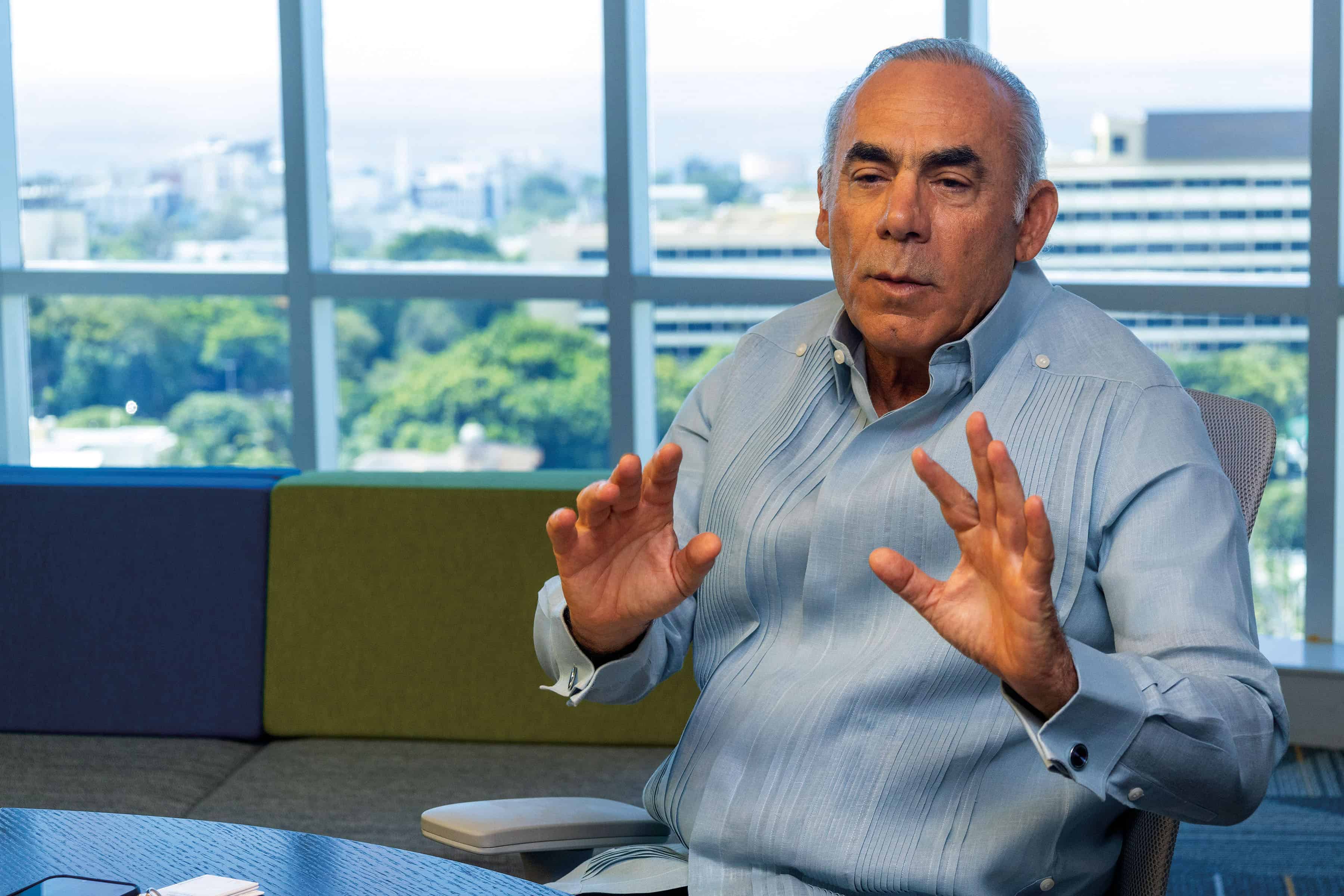

This was stated by its president, Emilio Hasbún, highlighting that total assets reached 3,167 million pesos, with a credit portfolio of 2,483 million and public deposits for 2,782 million pesos.

“He Atlantic bank It was consolidated in 2024 as one of the largest credit banks growth In the market. Obtained 24 percent of growth. An impressive thing, “said Hasbún.

Atlantic bankoriented to personal and business banking, has established itself as a close and technological alternative for people and businesses that seek accessible financial services. The company focuses on personalized attention, flexible credits and digitalization, with solutions for both employees and entrepreneurs and MSMEs.

“MSMEs value our personalized treatment and products adjusted to their needs,” said Hasbún.

The Executive indicated that the Atlantic bank It has reinforced its areas of technology and cybersecurity, and is developing a digital onboarding that will allow users to open accounts, request loans and obtain credit cards in a 100 % digital way.

He also announced the development of products such as corporate credit cards, money table (currency), factoring service and digital wallet.

Currently, the Atlantic bank It has a presence in Santiago, Punta Cana and the National District, and it is planned to open a new branch in Santo Domingo in September of this 2025.

Insurance General Bet on innovation

The president of the Board of Directors of Insurance GeneralMilagros de los Santos, explained to Diario Libre that the company was acquired by the Castillo Holding group in 2012, and since then has doubled its size in the last five years, positioning today as the eighth insurer of the country (not including those specialized in health).

Insurance General It manages more than 4.8 billion pesos in reservations and during 2024 he paid more 1,069 million in claims.

“We have exponentially increased the assets and assets. Currently, we manage reserves greater than 4.8 billion pesos, invested in a diversified portfolio in accordance with the regulations of our regulator,” said De los Santos.

The company’s current strategy focuses on Personal insurancewith massive, accessible and designed products for different segments of society, such as the “Cielo RD” program for Dominicans abroad.

Based in Santo Domingo and regional presence in Santiago, its vision includes digital expansion and the creation of innovative protection and forecast solutions.

“We are and want to develop people’s insurance. We are focusing a lot on that, people will always exist: products that are small, massive and easy to sell,” said the executive.

He pointed out that in 10 years they visualize a growth exponential. To achieve this they will focus on the Cibao region. “I think there is a lot of potential,” he predicted.

AFP Atlantic drives formalization

Launched in 2016, AFP Atlantic became the first Pension Fund Administrator (AFP) approved after the creation of the pension system in the country. In nine years, he has exceeded 100,000 affiliates, of which more than 49,000 actively quote.

Unlike other AFPs that concentrated their collection in large corporations, AFP Atlantic He decided to focus on small and medium enterprises (SMEs). This strategy allowed him to break through historically unattended segments, and accompany many of these companies in their formalization process.

“We have gone to the door, visiting workshops, bakeries, halls and other businesses to explain the virtues of the pension system. In many cases, we help the employer formalize and thus also its employees can quote,” said Filipo Ciccone, president of the Board of Directors of Administration of AFP Atlantic.

Among its most recent innovations is the mobile application “I am AFP Atlantic“, which drives voluntary savings and offers benefits in shops. In addition, it prepares the launch of a complementary savings plan for educational, patrimonial and pension purposes, aligned with the global tendency towards more robust and personalized pension plans.

“This new product will offer the possibility of saving for specific objectives: children’s education, the acquisition of a first or second home, or simply to guarantee a higher pension at the time of retirement,” he said.

AFP Atlantic It projects to double its size in the next three years, maintaining a focus on stability and regulatory compliance.