The Bulgarian National Bank (BNB) remains silent about the revelations, while there would be an “institutional umbrella” around the case.

MIAMI, United States. – The Bulgarian Prosecutor’s Office is investigating a possible money laundering scheme attributed to the regime Nicolas Madurowhich would have moved close to 500 million euros between 2017 and February 2019 through the Bulgarian bank Investbank, according to a resolution of the Attorney General’s Office of that country cited in a report published by the Bulgarian media Bivol.

According to the report, “between 2017 and February 2019, transfers were made for a total value of almost 500 million euros through 101 accounts.” These 101 accounts, the text specifies, did not correspond to 101 different owners, but were “special accounts of lawyers with a single owner: lawyer Tsvetan Tsanev”, indicated as “the only intermediary legally responsible for the movement of funds.” The report adds that there are indications that Tsanev would have been “at the same time a secret shareholder in the bank.”

The research described by Bivol maintains that, despite the total volume that would have transited through Bulgaria, only much smaller amounts were found when precautionary measures were applied. The text indicates that “some 450 million euros disappeared in accounts offshore linked to the Venezuelan regime” and that, “at this moment, only 46 million dollars are available and seized.” In another part of the report, the gap between what was transferred and what was effectively immobilized is emphasized: “at the request of the US authorities, only about 46 million euros were found in the accounts.”

The case would have attracted international attention since 2019. The report recalls that initial information about “just” 150 million dollars related to the Maduro regime in Investbank accounts was disclosed by intelligence services from the United States and Great Britain. Bulgarian authorities appeared at a press conference on February 13, 2019, along with the US ambassador to Sofia, Eric Rubin. According to the text, Rubin declared: “We are working with the Government of Bulgaria and other countries of the European Union to guarantee that the wealth of the Venezuelan people is not stolen and that they have the necessary support to ensure a peaceful and democratic future.”

The report also attributes to Radio Free Europe the broadcast of a statement by Venezuelan opposition deputy Carlos Paparoni, who stated that “Bulgaria is part of a large-scale plan to export state assets from the Latin American country.”

Two weeks after that public appearance, the Bulgarian Special Prosecutor’s Office began a preliminary investigation on February 26, 2019. However, the text indicates that the process was archived on June 4, 2024 by prosecutor Plamen Ivanov, “not because there was no evidence of criminal activity, but due to the transfer of the criminal process to the United States.” The alleged reason, always according to the report, was that the US authorities were in a “better position” to investigate the case. Despite this, he adds, the prosecutor ordered the DANS not to suspend surveillance of the accounts.

Regarding the destination of the funds that were not found in Bulgaria, the report maintains that “the money did not stay in Bulgaria, but was ‘redirected’ to other destinations.” Among these destinations, it mentions offshore companies in Panama, the United Arab Emirates and Hong Kong. Furthermore, it states that the electronic banking of these accounts was accessed “from hundreds of IP addresses in the United States and Venezuela”, with operations carried out “often in periods in which Tsanev’s proxies were not even in the corresponding countries”, which the text presents as an indication that those who operated the funds were linked to “representatives and intermediaries of Venezuelan state and quasi-state structures that were part of the Maduro regime.”

Investbank denied in 2019 that there were irregularities. According to the report, the bank declared that all transfers were legal and correct, and assured: “The incoming and outgoing transfers carried out are mainly related to the supply of food to Venezuela, for which we have the corresponding receipts. There are no sanctioned transactions in relation to the Venezuelan state oil company, PDVSA – Petróleos de Venezuela, SA.”

However, the text states that the case files maintain that there is a problem with the financial institution and that the prosecutor’s resolution of 2024 frames the movement of money as a transnational flow “coming directly from Venezuelan state companies such as the oil giant PDVSA, the Foreign Trade Corporation (Corpovex) and the state-owned Bank for Economic and Social Development (Bandes).” In that scheme, Investbank would have operated as an “intermediate link” within a chain that passed through Portugal, Liechtenstein and Switzerland.

The publication identifies Swiss entities and structures in opaque jurisdictions as part of the mechanism. According to the cited investigation, “part of the funds were returned to asset management companies (as payment for advisory services).” Among the companies mentioned is the Swiss Swiss Latam AG, owned by a Liechtenstein company, SP Holding AG SV. Both appear, according to the text, on a “list of suspects” along with other offshore companies registered in Panama and the United Arab Emirates.

The report adds that Swiss Latam AG, “later renamed Acantos Advisors AG,” would not have been a secondary actor, but rather a “central organizer” of the scheme, which recruited clients, coordinated account openings, gave instructions for the disposition of funds and received a percentage of the transactions.

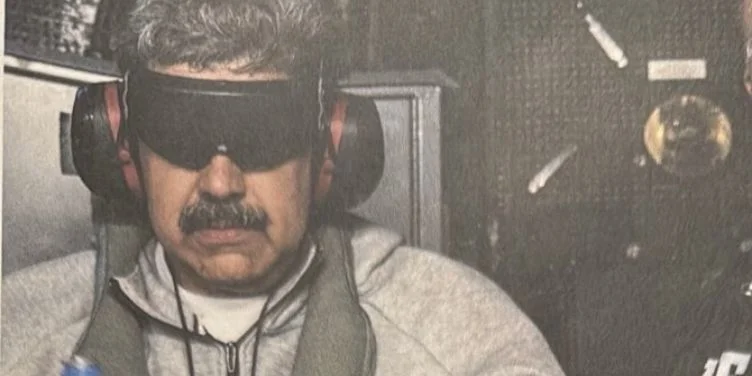

In the initial file of the case, the report states, it was stated that the funds were linked to instrumental companies of Alex Saab and his partner Álvaro Pulido after obtaining contracts for the supply of food for the CLAP. Likewise, the text indicates that Dimitriyka Andreeva, who acted as Tsanev’s main representative in opening accounts, was at the same time a member of the Supervisory Board of Investbank AD, which it describes as a “classic conflict of interest” that “has not received an institutional response so far.”

Towards the end, the report states that the Bulgarian National Bank (BNB) “remains silent” about the revelations and suggests that there is an “institutional umbrella” around the case. It also maintains that “300 million levs” of depositors’ money “has evaporated” due to government securities transactions with Tsanev companies, and that, although a former bank employee presented evidence, the prosecution refused to initiate pre-trial proceedings leading to a trial. The text concludes that the matter “is no longer just criminal, but regulatory,” and raises the need for an inspection of Investbank’s license by the European Central Bank.