The Bank of Brasília (BRB) informed that Jacques Maurício Ferreira Veloso de Melo resigned from his position as Legal Director of the institution. According to a relevant fact disclosed to the Securities and Exchange Commission (CVM) on Monday (9) evening, the executive’s departure will take effect next Saturday (14).

In the statement, BRB says that it will continue to keep shareholders and the market informed about relevant facts, reinforcing its commitment to ethics, responsibility and transparency. The bank, however, did not detail the reasons for the resignation nor did it inform who will take over as Legal Director.

The departure occurs amid the crisis faced by BRB after the institution’s involvement with Banco Master came to light, extrajudicially settled by the Central Bank in November 2025.

Jacques Veloso had been appointed Legal Director in August 2024, appointed by the governor of the Federal District, Ibaneis Rocha, to serve the remainder of the term starting in 2022, after the departure of the then incumbent. He officially assumed the role in December of that year and was already part of the bank’s governance as a member of the Audit Committee.

Also this Monday, BRB announced the inauguration of Ana Paula Teixeira as the new executive director of Controls and Risks. According to the bank, the executive has an established trajectory in the financial sector and served as vice-president of Risk Management, Internal Controls, Institutional Security and Cybersecurity at Banco do Brasil.

In a statement, BRB stated that the appointment seeks to strengthen corporate governance, institutional integrity and the institution’s risk management and internal controls.

>> Follow the channel Brazil Agency on WhatsApp

Master Bank

Veloso’s resignation and the change in management occur after investigations revealed operations between BRB and Banco Master that were considered irregular. In the period from 2023 to 2024, the public bank acquired two Master credit portfolios worth R$12.2 billion, made up of overpriced or non-existent assets, according to the findings.

In 2025, BRB even announced its intention to acquire control of Banco Master. The operation was approved by Cade in June, but ended up rejected by the Central Bank in September. Shortly afterwards, Master was liquidated by the BC.

According to a statement given to the Federal Police at the end of 2025 by the Central Bank’s Director of Inspection, Ailton de Aquino, the operations with Banco Master would have caused an estimated loss of R$5 billion in the BRB’s balance sheet.

Technical opinion and video

The resignation comes after a report on the website Metropolises reveal the existence of a legal opinion signed by Veloso in which he would have warned of risks in operations between BRB and Banco Master. In the document, the then legal director highlighted the importance of observing liquidity and Basel indices, considered essential to guarantee the solidity and stability of the financial system.

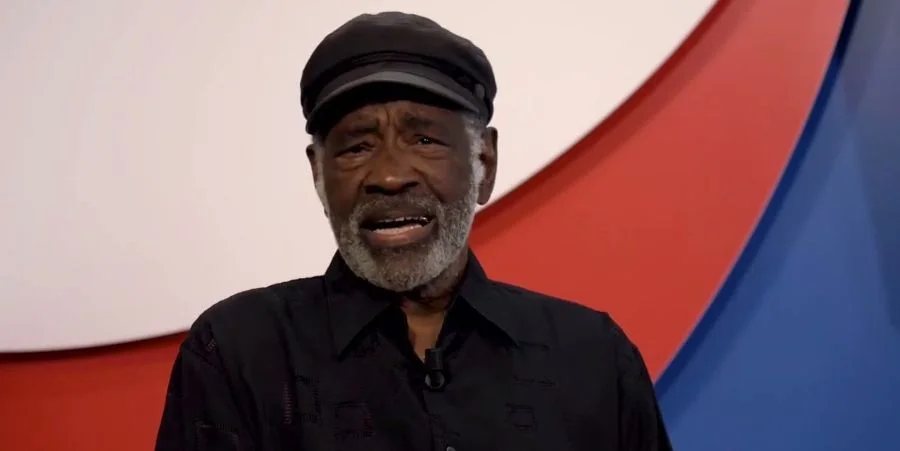

Despite the technical warning, Veloso also recorded an internal video in which he defended the attempted purchase of Banco Master by BRB. In the recording, sent to the institution’s employees after the announcement of the negotiation, he stated that “all legal precautions were being taken” so that the operation followed the legal and regulatory procedures applicable to the public bank.

The videos brought together testimonies from executives from different areas of BRB and sought to highlight supposed “technical advantages” of the acquisition, blocked by the Central Bank and later investigated by the Federal Police.

Recomposition

To contain the credibility crisis and reinforce liquidity, BRB presented to the Central Bank, on Friday (6), a capital plan with measures to restore the institution’s assets within 180 days. According to BC estimates, the minimum required contribution could reach R$5 billion.

The government of the Federal District, BRB’s controlling shareholder with around 72% of the capital, is closely monitoring the situation. The plan was delivered personally by the bank’s president, Nelson Antônio de Souza, at a meeting at the Central Bank headquarters in Brasília.