The National Bank for Economic and Social Development (BNDES) filed a lawsuit this Friday (26) seeking to enforce the debt owed by the Rio de Janeiro urban train concessionaire Supervia to the bank, in the amount of R$1.3 billion.

The measure is mandatory under the regulation of the banking sector and the legislation governing public services and was necessary due to the lack of agreement and a strategic plan that would present a financial solution to the impasse between the Rio de Janeiro government, which is the granting authority, and the concessionaire, the bank explained.

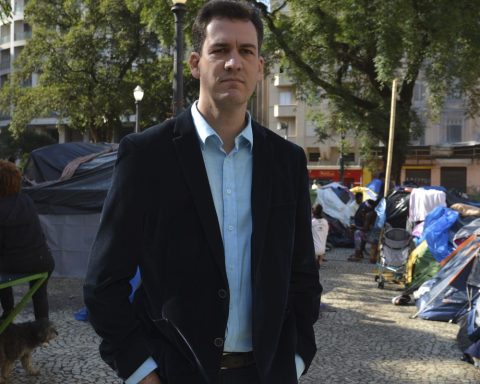

The Legal Director of BNDES, Walter Baère, informed that, as a public company that invests in development, the institution’s main concern is the concession itself and the best service provision.

“The bank is obliged, for governance reasons, to promote execution,” explained Baère.

The director said that there is a risk of the system collapsing due to the lack of any plan presented by the state of Rio de Janeiro to recover the concession and pay the debt.

According to Walter Baère, “the debt is not just with the bank, it is a debt with Brazilian society, as these are resources that should be reallocated by the BNDES to generate development in other areas that the country so desperately needs.”

The director noted that, in this impasse, the bank is only the creditor and it is up to the State Department of Transport to negotiate with Supervia a solution that guarantees the viability of the concession and the continuity of investments to provide services to the population.

“We challenged the State Secretariat several times, trying for a year and seven months, and we did not receive anything feasible in return that would give BNDES the belief that there would be a solution to the impasse between the concessionaire and the Rio government, unfortunately,” stated Baère.

Positionings

In a statement, Supervia reported that “it had been in negotiations with BNDES, however, due to the company’s current financial situation, already communicated to the judicial recovery court, it has not yet been possible to formalize the renegotiation of the debt with the bank”.

The government of the state of Rio de Janeiro reported that the contract was signed between Supervia and BNDES, without any intervention from the public authorities, “which therefore has no responsibility in this contract”.

In a statement, the Rio de Janeiro government stated that “Supervia cannot continue operating the system, given the concessionaire’s inability to offer a decent, high-quality service to the population.”

Even with the financial contribution made by the State Secretariat for Transport and Urban Mobility (Setram) after the pandemic, the concessionaire was not able to recover its financial balance, unlike other modes.

Setram understands that it is Supervia that must honor its debt with the state, due to the failure to fulfill the investments provided for in the contract. “The values presented by the company are being contested in court. Therefore, the State Secretariat for Transportation and Urban Mobility (Setram) is working quickly and transparently, but within the limits of the law, to present, soon, a definitive solution to the problems of the metropolitan rail transportation system.”

Modal

The financing was granted to the concessionaire in 2013 to support the concession of urban rail transport services in the metropolitan region of Rio de Janeiro, covering 12 municipalities, 270 kilometers (km), 104 stations and 201 trains. The resources were invested in the acquisition of newer and more modern trains, improvements to the railway infrastructure and quality of service.

According to BNDES, the investments were successful, resulting in increased use of the mode. At its peak in 2016, this transport network served 620,000 passengers per day. Currently, it serves around 300,000 passengers per day.

After the sharp reduction in passenger movement during the pandemic, Supervia and other companies in the business group, now controlled by Guarana Urban Mobility Incorporated (Gumi), which represents the Mitsui Group, filed, in June 2021, a request for judicial recovery, which is still being processed in the 6th Business Court of Rio de Janeiro.

The judicial recovery plan does not include the BNDES credit, because the bank had the guarantee of its own concession receivables. In technical terms, this is an extra-bankruptcy credit, that is, it does not participate in the consortium of creditors of the judicial recovery.

The BNDES pointed out that a way to enable the continuity of investments and service provision would be through an extension and complete review of the contract, with a plan for a new contractual addendum or even a means of re-bidding.