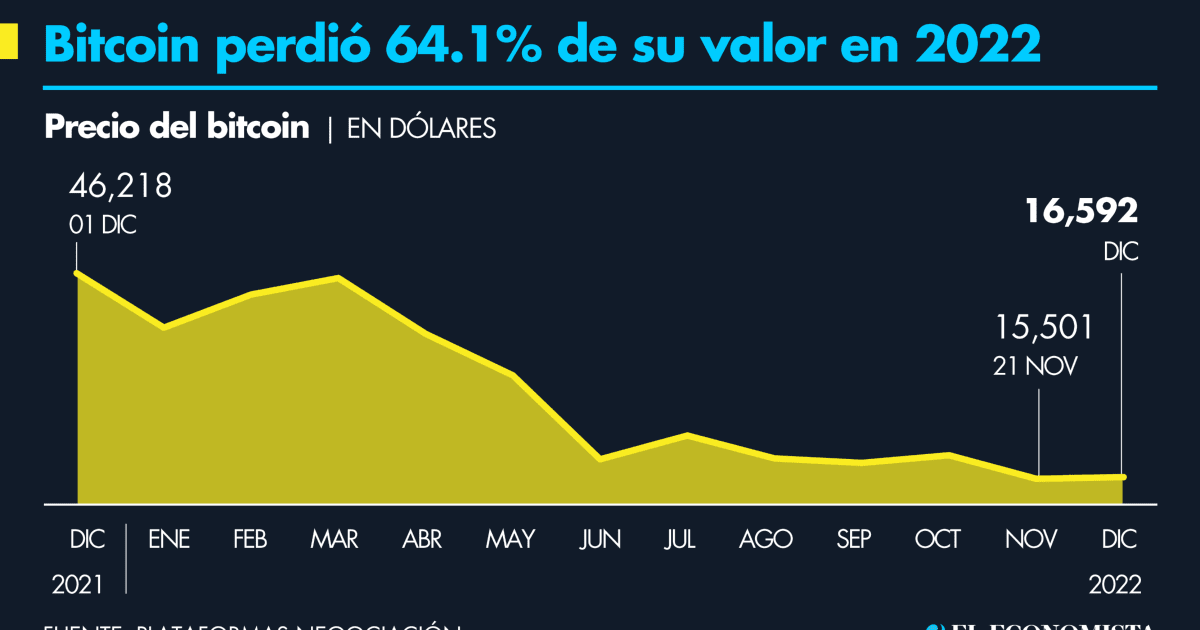

With the exception of bondholders, holders of virtually every financial asset have suffered the effects of a stormy 2022. But there is no doubt: in 2022 no one suffered as much as the enthusiasts of Bitcoin and the cryptocurrencies.

The bitcoin price it deflated 64% from almost $30,000 on December 31, 2021 to less than $17,000. In annual terms, it is the worst movement for which it was created without yet achieving it: being a vehicle to run ahead of inflation.

In percentage terms, the negative period that includes this fall in Bitcoin is surpassed only by the decrease observed between December 2017 and January 2018, of almost 84%. In terms of capitalization amounts, there is no comparison.

Bitcoin’s fall in 2022 came in a year when professional investors were beginning to set their sights on this technology. This is one of the reasons why the enthusiasm increased the amounts in falls that were bigger and bigger.

risky asset

It was the characteristics of this market that once again brought misfortune to digital enthusiasts. The crashes of the Terra Luna, FTX, Alameda Research, and BlockFi stablecoin emphasized the discussions about the problems due to its lack of regulation.

Its correlation with the stock markets, especially with the big technology companies, ended the thesis, at least this year, that Bitcoin is digital gold or a form of value protection even similar to what the dollar offers.

Quite the opposite. Bitcoin has been affected by an environment of high inflation, pressured by episodes of aversion to risky assets and, above all, by expectations of a more “tight” economy due to rate increases by central banks.

Bitcoiners don’t give up

Despite this complex scenario, the moderation of inflation in the most recent data from the United States and in the increase of 50 points to the Federal Reserve rates after four increases of 75 base points made its price recover in some sessions.

The most recent ceiling for Bitcoin was $18,373 on Dec. 14, just minutes before the Fed’s easing of rate hikes. Though it slowly lost it, the move showed that crypto enthusiasts are far from giving up. .

A survey of 40,000 users of the Explorer service of Blockchain.com, the largest cryptocurrency site by traffic in the world, revealed that 40% of respondents plan to buy more crypto in 2023. Will you?