The president of the Senate, Rodrigo Pacheco (PSD-MG), has shown interest in putting the Complementary Bill (PLP) 18/2022, to reduce consumer fuel prices. Currently, the project is in the Chamber, but Pacheco already intends to mobilize the leaders to discuss the issue.

The project proposes the exemption of energy, telecommunications and transport tariffs, and is being processed together with the PLP 211/21, which sets a limit for the taxation of essential goods, especially energy, oil, telecommunications and gas. The texts are on an urgent basis and can be voted on by the plenary at any time.

The processing of the projects was the subject of a conversation between Pacheco and the mayor, Arthur Lira, which took place yesterday (19). After the meeting, the senator took to Twitter to comment on the meeting.

“I pledged to bring to the leaders the issue that can contribute to reducing the impact of state taxes on fuel prices. I also highlighted the importance of the stabilization account, approved in the Senate, in PL 1472/21, as a measure to be considered by the Chamber”, he said, on the social network.

THE PL 1472/21 he was passed the Senate in March and went to the Chamber. The project changes the way fuel prices are calculated, in addition to creating a Stabilization Account. The text also stipulates that the prices of petroleum-derived fuels practiced in the country have as a reference the average quotations of the international market, the internal costs of production and the costs of importation.

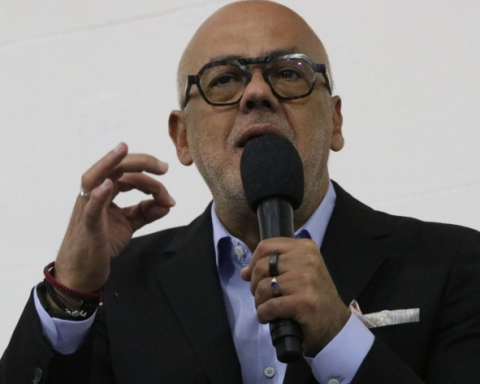

The project’s rapporteur, Senator Jean Paul Prates (PT-RN), listened to the sectors involved and also to the government, in an attempt to build a text in consensus with as many parliamentarians as possible. The bill, however, does not advance in the Chamber.

Jean Paul has even demanded, in his speeches in the Senate tribune, the vote on the bill in the Chamber. According to the senator, this project “can at least return to Brazilians, and not entirely to shareholders, part of Petrobras’ profits from the increase in oil prices and the amount charged for imported derivatives”.