He Central Reserve Bank (BCR) confirmed that the new retail payments platform will enter its third phase in July 2026, as part of the project developed together with the National Payments Corporation of India (NPCI).

This third stage will end in December of that time and that month a pilot will begin where the deployment of the new functionalities will be seen.

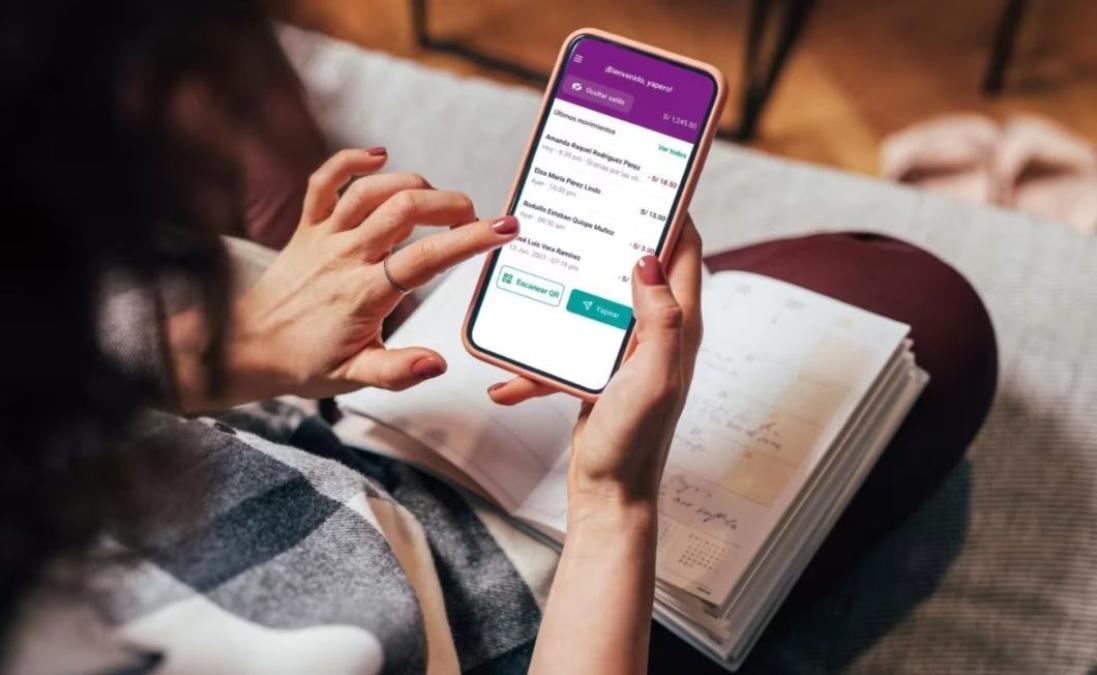

This infrastructure, based on the Unified Payments Interface (UPI) model used in India, will complement the current payments ecosystem by incorporating new use cases and an open access scheme for financial and non-financial entities.

According to the BCR, the platform will make it possible to address challenges of the National Payment System by promoting role specialization, strengthening operational infrastructure and facilitating a centralized payment initiation model. With this, wallets and applications will be able to initiate transactions from deposit accounts or electronic money under common rules.

He indicated that the project is carried out in three phases. Phase 1, completed in June 2025, adapted the UPI model to the Peruvian environment and defined interoperability with the Electronic Clearing House.

Phase 2, ongoing until June 2026, includes infrastructure implementation and software preparation, as well as the installation of two active-active Data Centers.

Phase 3, scheduled between July and December 2026, contemplates live departure using a controlled pilot. For this initial deployment, the BCRP selected 14 entities.

Receive your Perú21 by email or WhatsApp. Subscribe to our enriched digital newspaper. Take advantage of the discounts here.

RECOMMENDED VIDEO