A bill presented by the Central Bank of Bolivia (BCB) to the Legislative contemplates the use of gold reserves as collateral to obtain international credits and the eventual conversion of bullion into foreign currency, to improve the liquidity of net international reserves ( RIN).

Both provisions are inserted in the project of “National Production Gold Law Destined to the Strengthening of International Reserves”, whose approval is managed by the issuing entity.

The document, to which EL DEBER had access, has two objectives: to authorize the Central Bank to carry out international financial operations with gold reserves and to allow it to purchase gold produced in the country.

Paragraph I of the First Additional Provision modifies article 16 of Law 1670 of the BCB, thus eliminating the pledge of gold reserves with legislative authorization and including the functions of the BCB (to manage, invest and make deposits in custody of the RIN) the tasks of transformation and collateralization of these values in operations that “strictly improve the performance of the reserves.

To this end, it may “use hedging instruments and/or swap operations, ensuring their profitability, protection, security and necessary liquidity”.

Paragraph II also establishes that “the gold reserves, if necessary, may be used to convert them into foreign currency, in order to improve the liquidity position of the NIRs.”

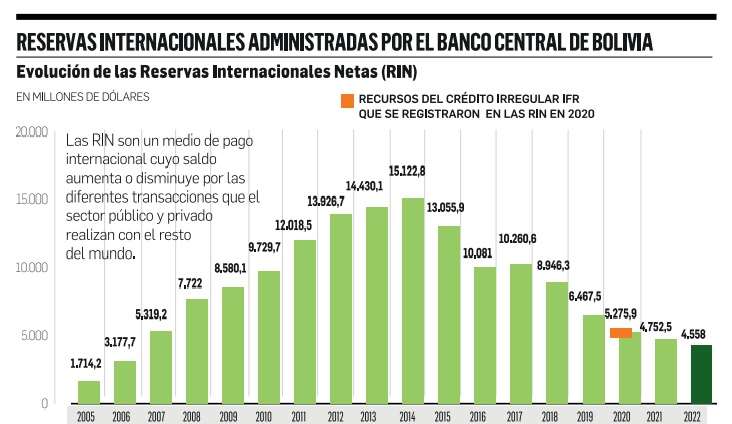

This information is known after financial analysts observed the fragility of the reserves, which would put at risk the payment of imports and foreign debt, as well as the stability of the national currency. The Government, for its part, highlights the stability of these assets.

The situation of the RIN is “increasingly difficult” and the Executive needs reserves in “cash (foreign currency)” to meet all that is necessary, said deputy José Guillermo Benavides.

With this bill, “the gold reserves will be able to guarantee future international credits that will allow the Government to survive,” said the legislator, who added that since the country has a low international risk rating, it is more difficult for it to access external resources.

For the strengthening of reserves, the legal proposal also provides in its article 3 that natural and legal persons legally established, registered and authorized by the competent entities “must offer all of their production or possession of the gold mineral destined for the export”.

The obtaining of this metal by the issuing entity will be carried out based on an acquisition program. Once the national production gold purchase quota has been met, the BCB will issue a free availability certificate, which will allow bidders to export the surplus.

The BCB will also pay for the gold in national currency “based on the price of the international price” and “in competitive conditions”.

Natural or legal persons who sell gold “will be exempt from paying Value Added Tax (VAT) and Transaction Tax (IT)”.

A legal report from the Ministry of Economy on the bill indicates that the purchase of local gold at an international price will generate a comparative advantage with respect to exports, since producers and marketers will avoid incurring operating costs that imply the sale at market price. international.

Scope of the proposal

Deputy Benavides lamented that this bill does not address gold mining in a comprehensive manner, since it is an activity that is carried out by overwhelming protected areas and causes contamination of rivers with mercury, in addition to other negative connotations such as the affectation of the surrounding towns.

“It is a project that is only reduced to the purchase of cooperatives,” he observed.

Under this framework, the Government signed an agreement earlier this month with the Regional Federation of Gold Mining Cooperatives (Ferreco) and the Federation of Gold Mining Cooperatives (Fecoman) —two of the main producers of the metal in the national territory— to give green light to the gold bill.

“After the meeting with the president (Luis Arce), we have made practically no progress. That is why I am going to meet with the minister on Wednesday (for today), informed Ferreco’s president, Eloy Sirpa, without giving details.

Data from the Ministry of Mining show that cooperatives produce 94% of the national gold.