September 7, 2022, 4:00 AM

September 7, 2022, 4:00 AM

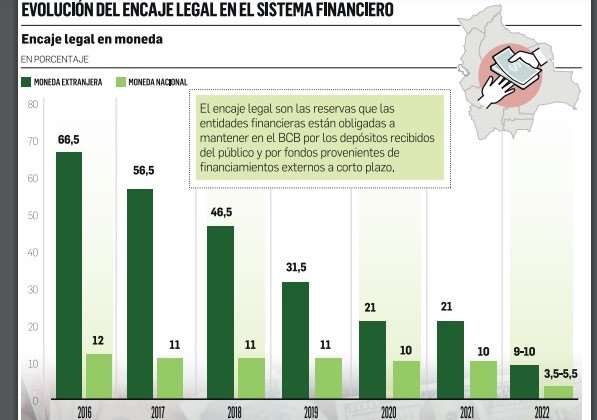

In order for banks to have more liquidity to give credits, the Central Bank of Bolivia reduced the legal reserve, which is the reserve that each financial entity is obliged to keep as backup for the deposits it receives in national or foreign currency. This is the seventh reduction in the last seven years.

The new Legal Reserve Regulation for Financial Intermediation Entities, approved by the BCB board on August 26, 2022, reduces the reserve requirement in foreign currency from 21% in 2021 to 10% in the case of cash resources and to 9 % in the case of securities. The reserve requirement in national currency (in Bolivians), on the other hand, is also reduced from 10% to 5.5% for cash and 3.5% for titles.

This means that for every 10 dollars of savings or fixed-term deposits (DPF) that it receives, each bank must deposit one dollar in the BCB; a very different situation from 2016, when each bank had to deposit almost 7 dollars in the issuing entity for every 10 it received from the population.

This is the sixth time since 2016 that the Central Bank has decided to make this adjustment for foreign currency deposits. Since that year, the indicator has decreased by 56 percentage points.

“A reduction in the legal reserve grants greater liquidity to financial institutions so that they can allocate more resources for loans,” explained Armando Álvarez, former general manager of the Bolivian Stock Exchange, who acknowledged that the modification of the reserve requirement in dollars could, likewise, be related to another reason other than “less liquidity in the financial system”.

If the reduction in the percentage of legal reserve “was destined to improve the reserves of the BCB, this operation would have to be complemented with another that allows the Central Bank to receive dollars ‘liberated’ from the banks due to the reduction of the legal reserve. Also, you should hand them over to banks for lending.

This has already happened with the CPVIS II and III Funds (for credits for the Productive Sector and Social Interest Housing).

The economist explained that the resources released are destined to finance funds already authorized or recently created by the Government, such as those that promote credit to the productive sector and the use of renewable electric energy. “The Government is concerned about the lower rate of placement, especially in these funds,” he said.

With regard to a possible impact of the measure on the currencies of the net international reserves (RIN), Espinoza considered: “It is possible that some of these resources end up in the reserves, but the impact will be less.”

This medium contacted Nelson Villalobos, executive secretary of the Association of Private Banks of Bolivia (Asoban), to find out the scope of the measure in national banking. The executive replied that they are analyzing the provisions.

The last time the legal reserve in foreign currency was adjusted was in April 2019. On that occasion, the issuing entity explained that “the purpose is to provide money intended for circulation through banks” and to ensure “availability for the Granting of credits to those who require it. With this, the aim was to avoid an upward trend in the interbank interest rate and in the repurchase agreement rate.

The modification of the legal reserve occurs at a time of economic slowdown in which the Government competes for internal financing resources and in which the entities of the financial system do not have regular income due to two factors that influence their ability to give financing to the public. These factors are the deferral of credit payments in the first year of the pandemic and the rescheduling of loan payments due to the extension of the health emergency.

BCB reports detail that the gross placements of the General Treasury of the Nation (TGN) for fiscal policy purposes; that is to say, the capture in the internal market of resources for the state budget through securities, increased by 150% in the last administration, from Bs 5,319 million in 2020 to Bs 13,321 million in 2021.

The 2022 Financial Fiscal Program, signed by executives of the Ministry of Economy and the Central Bank on March 29, contemplates internal financing for the public sector of Bs 19,750 million, an amount that includes credits from the BCB.