During the press conference in which it presented its results for the third quarter of 2025, BBVA Mexico executives were questioned about the constant criticism that the new app of the Spanish bank has received.

In response, they assured that it is an adaptation process and that, over time, users will end up loving this version, which integrates cutting-edge technology to improve the mobile banking experience.

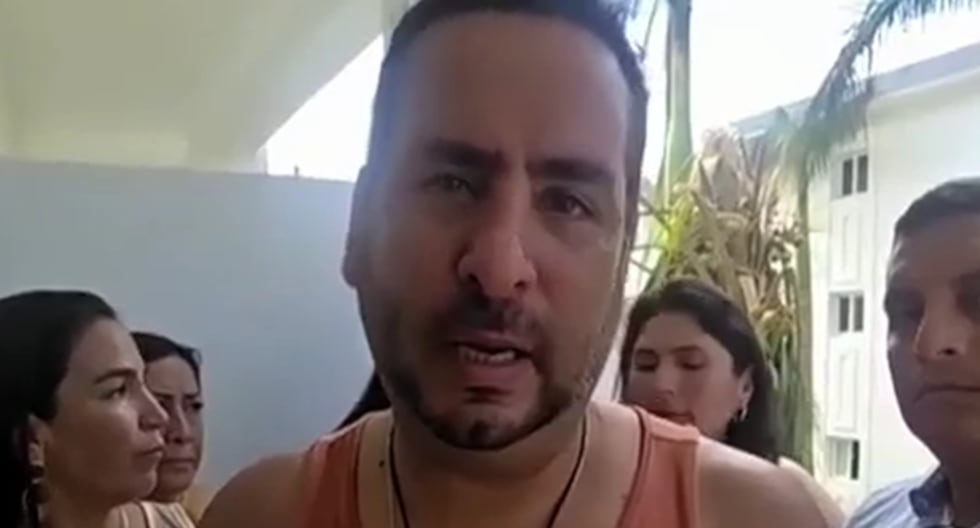

“It’s easier, you just have to walk with it,” said Hugo Nájera, general director of retail banking at BBVA Mexico, and added that “this application is like Netflix for banking, that is, it is full of boxes that are filled with the content that you use. So, what should appear is what you frequently do.”

BBVA and its 27 million apps

According to the bank, it is no longer a single app for 27 million customers, but rather 27 million apps, thanks to the hyper-personalization that artificial intelligence allows. Each person can build their own mobile application according to their tastes, needs and preferences.

-BBVA explained that this version improves the way in which users perform different actions, such as:

-Fast payments with your cards

-Payments through CoDi

-Hyperpersonalization based on each person’s activity

-Use of a virtual assistant powered by artificial intelligence

-A personalized card with Apple Intelligence

The bank assured that its app was already the best on the market, but with this update the experience is even more complete.

What are the complaints against the BBVA app?

Complaints against the new BBVA application have multiplied on social networks, where users have shared memes, videos and comments about the difficulties they face with the update.

Many consider that the previous version was clearer, more intuitive and easier to navigate, while the new one is confusing and impractical. They point out that options that were once within reach are now difficult to locate, delaying simple and quick operations, such as transfers or payments.

Some users have also pointed out that hyper-personalization, which allows the app to be configured according to each client’s preferences, does not always work efficiently, causing frustration and the feeling that operations take more time than necessary.

Faced with these criticisms, Eduardo Osuna, vice president and general director of BBVA Mexico, assured that resistance to change is natural, but asked users to remain open to learn about all the advantages that the new version offers.

In this way, the bank’s millions of clients are expected to adapt to the changes in the coming weeks.