As of March 2022, the total assets of the Development Banking totaled 2.3 trillion pesos. Investments in financial instruments and the loan portfolio with stage 1 credit risk represented the main items of total assets, with shares of 44.5% and 42.7%, respectively.

According to the National Banking and Securities Commission (CNBV), the balance of the total loan portfolio stood at 1.02 trillion pesos, which represented 44.4% of total assets.

With regard to the item of debtors for repurchase agreements, securities lending, derivatives and valuation for hedging, it was 69,100 million pesos. This item represented 3.0% of total assets.

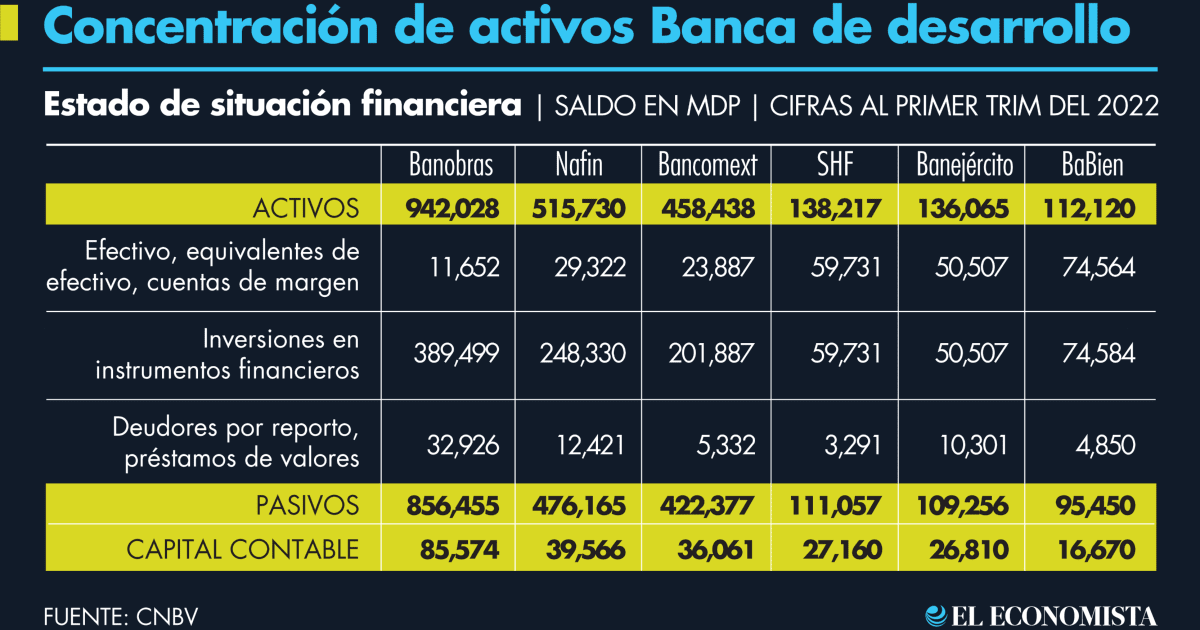

The largest entities in the sector, in terms of participation in total assets, were Banobras with 40.9%, followed by Nafin with 22.4% and Bancomext with 19.9 percent.

Likewise, the credit portfolio is made up of: the stage 1 credit portfolio, with a balance of 982.7 billion pesos, which represents 96.2% of the total credit portfolio.

The stage 2 loan portfolio recorded a balance of 6,200 million and represented 0.6% of the total and the stage 3 loan portfolio had a balance of 32,600 million, with a 3.19% share of the total amount of the portfolio.

The balance of the loan portfolio of the three largest institutions represented 89.5% of the total: Banobras, 49.2%; Nafin, 18.4%; and Bancomext, 21.9 percent.

The Development Banking sector is made up of six institutions: National Bank for Public Works and Services (Banobras), National Finance Bank (Nafin), National Bank for Foreign Trade (Bancomext), Federal Mortgage Society (SHF), National Army Bank, Air Force and Navy (Banjercito) and Banco del Bienestar (BaBien).

Delinquency Rate

The federal agency reported that the sector reported a delinquency rate (IMOR) of 3.19% as of March 2022.

In this way, the IMOR of the commercial portfolio was 3.18%, within this concept, the IMOR of the portfolio to companies was 6.65%, while the IMOR of the portfolio to financial entities closed at 2.35%, the IMOR of consumer credit stood at 2.10%. and the IMOR of the housing portfolio reached 8.48 percent.