January 22, 2023, 22:26 PM

January 22, 2023, 22:26 PM

2023 will be a complex and unpredictable year in many aspects, a recessive macroeconomic environment, high inflation, market volatility and an increase in interest rates are forecast. At the same time, great challenges are coming for the banking sector, which, in addition to maintaining its growth and solidity, must innovate with new products and services, adopting technologies that allow satisfying the needs and experiences of an increasingly omnidigital customer.

The immediate future for the sector lies in open banking, the increase in digital transactions, the use of the cloud and artificial intelligence, mobile wallets and the increasingly important advance of ‘neobanks’ and ‘fintech’. Given this scenario, it is important to cite the main trends for banking in Latin America and our country, in the search for greater banking access and sustained growth.

Although the customer service model will continue to be hybrid (physical and digital branches), the trend is for branches to close as there is a greater degree of digitization of services and greater adoption by users of web and mobile banking. . Without forgetting that the warmth in face-to-face customer service will continue to be important.

The open banking model will have a faster evolution because the regulation, in several countries of the region, is already allowing it. In this way, banks will be able to provide open access to their customers’ banking and financial data to other entities interested in providing financial services. This will allow the client to enjoy a greater number of tailor-made products, security and transparency with the use of data, new forms of financing and better planning of their personal finances.

The advance of fintech is another important trend that will facilitate various payment and personalized solutions to find sub-segments of the market that banks are not exploiting. It is expected that with an open banking regulation and a specific one to regulate the emergence of fintech, these will be able to provide a greater range of financial solutions, more comfort, speed, more access and lower costs for customers.

The search for better customer experiences through technologies, such as Artificial Intelligence (AI) and Machine Learning, is one of the most important trends in the search for a better relationship between banks and customers, avoiding the points of friction and constantly improving the customer journey.

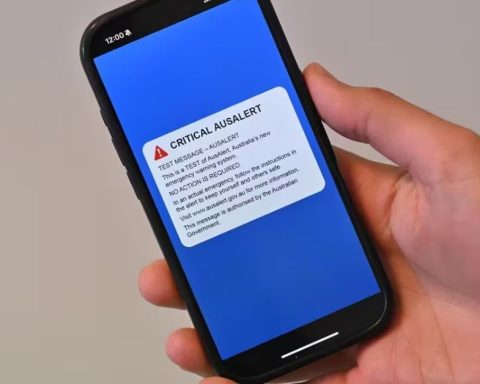

The digital advance of banking must be accompanied by the strengthening of security, which is threatened by new tactics used by cybercriminals. In this sense, the trend is for financial institutions to increase their server security and data privacy, taking into account compliance with increasingly strict regulations on privacy and data protection. Banks are making significant investments in facial recognition technologies, fingerprint readers and tokens, increasingly sophisticated as a differentiating element and to prevent fraud.

The use and greater exploitation of customer data, through technologies such as big data, becomes a trend to generate competitive advantages as long as that data is of quality and that it serves to create more accurate business strategies to reach new markets. or with new products. A large part of these technological trends are already being implemented in our financial system, which represents great benefits for banking customers and users.

*Jorge Velasco is an expert in banking and innovation