May 17, 2023, 7:31 PM

May 17, 2023, 7:31 PM

The Supervisory Authority of the Financial System (ASFI) affirmed this Wednesday that the participation of Banco Unión SA in the awarding of the assets and liabilities of Banco Fassil SA “is fully valid and it does not in any way contravene the provisions of paragraphs IV and V of Article 330 of the Political Constitution of the State”.

“The solution procedure applied to the Intervened Bank, in which Banco Unión SA participates, along with eight other banking entities in the country, is carried out in strict adherence to legal provisions contained in the aforementioned Financial Services Law, so it is fully valid and does not in any way contravene the provisions of paragraphs IV and V of Article 330 of the Political Constitution of the State,” he said in a statement.

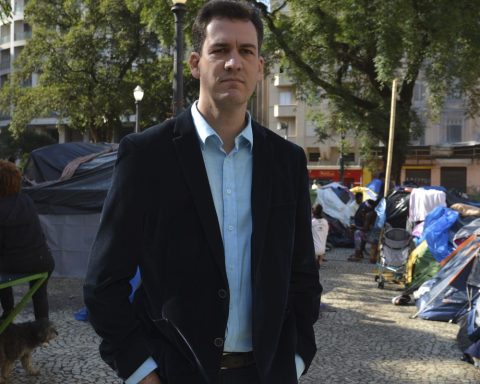

In this way, he responded to the deputy of the opposition Comunidad Ciudadana (CC) Carlos Alarcón, who said that Banco Unión SA “would have the legal status of public entity or institution”, which is why their participation in the settlement procedure applied to Banco Fassil SA would be “illegal and unconstitutional”.

Since Banco Unión is the public banking entity of art. 330 IV and V of the CPE, due to the constitutional prohibition of this rule, cannot participate in any portfolio acquisition of Banco Fassil that entails the assumption or recognition of debt of this private bank. pic.twitter.com/sUrTXUHeT5

— Carlos Alarcón (@carlosalarconmn) May 12, 2023

“These statements lack veracity and are totally unrelated to the constitutional provisions,” emphasized ASFI.

The statement argues that “the main line of business of Banco Unión SA is the financial intermediationthat is, carry out operations with the public to attract savings and place loans, regardless of its status as a ‘public banking entity’ within the framework of Law 331”.

“Therefore, by not becoming a public entity or institution as such, it is fully empowered to carry out asset and liability transfer operations from other financial entities under the regulatory framework provided by Law No. 393 on Financial Services”, clarified the regulatory entity.

As a result of the solution process in charge of the ASFI, nine banks (Bisa, de Crédito, Económico, Fie, Ganadero, Mercantil Santa Cruz, Nacional de Bolivia, Unión and Solidario) took over the portfolio and savings accounts of the financial entity Fassil intervened.

He May 22 will conclude the migration of the Banco Fassil database to the nine entities, which will allow savers to access their money and borrowers to pay their loans to the financiers assigned to them.

On April 26, Banco Fassil was seized by ASFI, due to complaints and a series of irregularities in its administration. The Government affirmed that the money of the savers of the financial institution is guaranteed.