Marco Belmonte / La Paz

Analysts warn that the war in Ukraine will have a negative impact with a drop in economic growth worldwide and in Bolivia, and a rise in prices at a time when countries seek a recovery after the covid pandemic.

Juan Antonio Morales, former president of the BCB, pointed out that a first effect is the increase in prices of raw materials produced by Bolivia, such as tin and oil, which reached over 100 dollars yesterday.

A rise in inflation is expected in the United States (USA) due to the bottlenecks that the war will produce, as well as in the value of fuel. “If inflation rises in the US, interest rates will rise and that may have an effect on the government’s intention to place more bonds on the international market,” he specified.

Morales argued that the main obstacle to the country’s growth is the difficulty it has in obtaining financing, and this harms public investment.

“The prices of raw materials are rising, but the problem is that Bolivia does not have enough gas supply, since production has been falling for several years. You can take advantage of the rise in metal prices, but the taxes and royalties are low”, he pointed out.

Analyst German Molina said that the world economy, including Bolivia’s, will contract because the entire productive apparatus of Europe, the US, and Russia will go to the military sector and world trade will suffer the effects.

This is because shipping from one country to China or Europe will no longer be easy. Added to this is the general fall in the stock markets. “In our economy, the trade balance will suffer impacts; if exports fall, the Net International Reserves (NIR) will stagnate, the fiscal deficit will remain high and there will be less economic growth, it will not reach 5.1% as the Government forecasts”, he pointed out.

According to Molina, with a worldwide conflict in economic agents, families and consumers, prudence in income and expenses must prevail.

The manager of the National Chamber of Exporters (Caneb), Marcelo Olguín, indicated that the conflict will have repercussions on the prices of wheat and corn.

In the case of the first grain, the country is not self-sufficient and it is imported from Argentina, Canada and the US to process flour for bread. “The increase in the price of wheat and corn, with Ukraine and Russia being major producers, could create difficulties, since Bolivia will require more resources to import the same amount of wheat,” he warned. The same will happen if corn is imported.

Álvaro Ríos, former Minister of Hydrocarbons, said that in 2021 the trade balance between gas exports and imports of gasoline, diesel, additives was favorable at 30 million dollars with an international oil price of 70 to 75 dollars. “But this year with an oil price of 95 dollars, that generates negative numbers in the energy trade balance of approximately 250 to 300 million dollars. It all depends on the price, but with 95 dollars there will be an energy deficit”, pointed out Ríos when referring to the effects of the conflict.

“The problem is the drop in gas production and exports. In 2014, when we had good prices, we exported 47 to 48 MMmcd of gas, now the export capacity does not reach 28 or 29 MMmcd”, he remarked.

Mauricio Medinacelli, former Minister of Hydrocarbons, warned that energy prices will rise and this will cause a slowdown in the world economy. If the conflict arose in 2015 with the rise in oil prices, Bolivia would have received 900 million dollars in taxes and royalties.

“The subsidy that year reached 100 million dollars. There was a profit of 9 to 1 in favor of Bolivia (export vs. import), but today the ratio is 2 to 1 and a profit of 500 million dollars if this is maintained and the subsidy reaches 250 million dollars”, he indicated. at Unitel the analyst.

The economist Gonzalo Chávez warned that there will be a reduction in growth, after a 2021 in which a recovery of the economy was observed. “The economy was re-oxygenating in some way; With this crisis, what we are going to see in the following weeks is an increase in inflation in the world, the slowdown in the recovery of the economy and financial crises, ”he warned in Central Affairs.

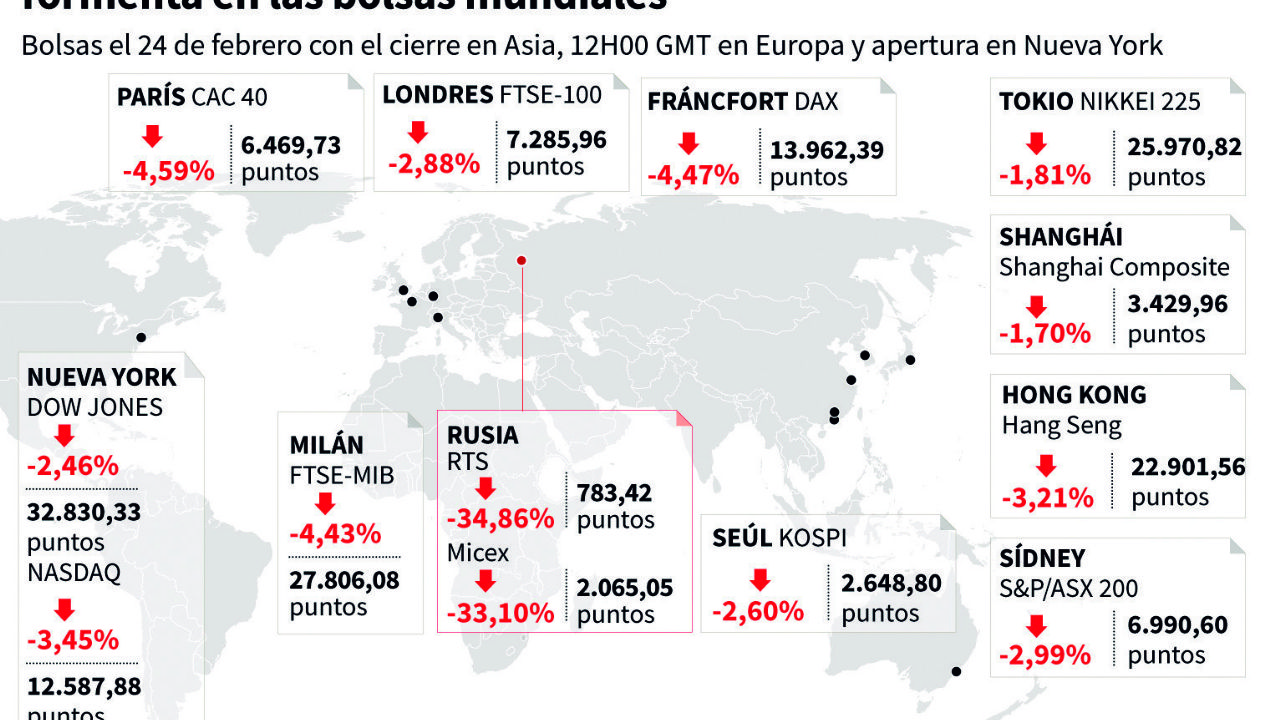

Yesterday the European stock markets fell by up to 5%, raw materials soared and Wall Street ended up after the Russian invasion of Ukraine.

Economist lists 10 negative effects after Russian invasion

1. Due to supply and circulation problems, this year will experience a negative global growth rate. There will be a shortage of strategic and essential goods.

2.- price inflation of commodities and essential goods: oil, gold, silver, wheat, corn, soybeans, coffee, sugar. Food will rise, they fulfill the function of reserve value, and in war they are essential.

3.- Appreciation of the dollar against the currencies of countries involved in the war. 4.-Fall in the purchasing power of workers’ income and greater poverty.

5.- There will be a trade surplus for countries that export essential and strategic products. Importers of these products will have a trade deficit.

6.- The stock market value of companies listed on the stock exchanges will tend to fall due to the effect of economic contraction and uncertainty.

7.- The prices of sovereign bonds of countries, debt issuance, will tend to rise. Interest will go up.

8.- Greater enrichment will be generated for companies and nations that produce essential and strategic goods. The results will depend on the “war winners”. In the first and second world war the USA was the winner and established world hegemony

9.- As a result of the war and the fall in the purchasing power of the income of large sectors of the population, there will be waves of migrations from the north to the south of the planet.

10.-. It will increase global poverty and inequality.