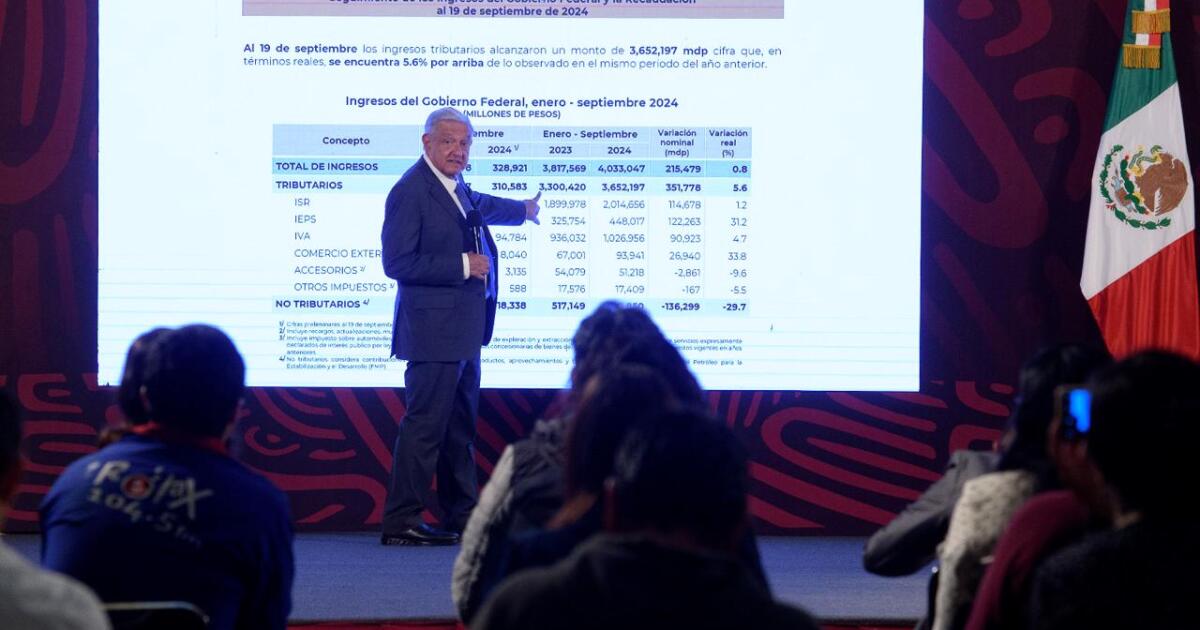

By applying this recipe, he said, tax collection has increased year after year. The president said that during his administration, tax collection has been increasing year after year.

For example, he explained that in 2018, the amount collected was 2 billion pesos and a year later – the first of his administration – the figure increased by 2.5% to collect 2.2 billion; by 2024, the last year of his Government, the amount collected was 3.3 billion.

He explained that the fact that tax write-offs for large companies, as had happened under other governments, also helped to increase tax revenue.

“Let tax evasion not be allowed, let there be no privileges, let taxes not be forgiven for the wealthy, let us all continue to contribute and there are sufficient resources, that is, the income is sufficient. We have increased tax collection without the need to collect more taxes or create new ones,” he said.

Tax reform for Sheinbaum?

Prior to the start of Claudia Sheinbaum’s government, experts have considered that due to the budget deficit, a tax reform is necessary to increase tax collection and fulfill her campaign promises, including the continuation of social programs.

However, the president-elect herself has denied that she has any fiscal reform planned. “In principle, no, I am not thinking of a deep fiscal reform. I think there are still many opportunities for tax collection,” she said.