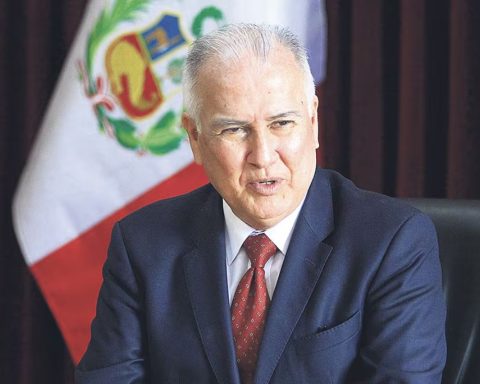

Early withdrawals of retirement savings directly affect AFP members because they reduce their future pensions and also harm all Peruvians because they make loans more expensive and negatively influence job creation. This was stated by the former Minister of Economy and advisor to the Association of AFPDavid Toesta.

The expert, who presented the document called “A review of the short-term and long-term impacts of early withdrawals from pension funds during COVID-19″, He explained that any early withdrawal of retirement savings has a direct impact on the future pensions of the members, mainly if they are not focused on the people who really need it.

“This document, which analyzes the impact of the five withdrawals of funds made during the pandemic, records how the preference for current consumption affects the future pension of members who withdrew their savings and, in addition, details how they influence the economy of all peruvian”, said the former minister.

As an example, he said that a 30-year-old member who made withdrawals, taking into account the average salary of this segment, lost the equivalent of 15 years of contributions.

“Early withdrawals, for those who maintain a fund in the Private Pension System (SPP), meant the deterioration of pensions by reducing the savings horizon of the youngest affiliates by almost half, where a 30-year-old affiliate, with a 50% contribution density, it reduced its investment horizon by up to 15 years. In addition, members between 45 and 60 years old would have to postpone their retirement for up to 5 and 1 year, respectively, to recover what was withdrawn.”, he detailed.

everyone’s economy

Regarding how early withdrawals affect the economy of all Peruvians, Tuesta stated that it has been shown that countries grow more when they have higher savings rates, and in the five withdrawals, about S/ 66,000 million have been withdrawn from the system.

“The higher level of savings allows a country to invest more, both in public and private projects, generating jobs. All this has effects on growth, through increases in the productivity of the economy. In addition, any early withdrawal has a negative impact on the capital market and, therefore, the availability of loanable funds, making the credit granted to families (mortgages, loans or credit cards) more expensive.“, held.

He added that also, due to early withdrawals, 2.33 million affiliates have been left without funds for retirement, exposing them to the risk of falling into poverty during old age, resulting in a burden for the family group or for the State.

“That is to say, a load that all Peruvians will have to pay for with the payment of taxes.”, he pointed out.