Corporation Actinvera financial group with participation in the banking, lease and investment funds, reported operational income of two thousand 572 million pesos in the second quarter of the year, an advance of 27% compared to the 1,858 million of the same period of 2024.

The company said it achieved improvements in its financial and operational performance despite the fact that the period was characterized by market volatility, a situation that, however, allowed the expansion of the operator and a greater contribution of commissions income.

Besides, Actinver He said he had a net utility of the controller of 416 million pesos in the quarter, which was 51% above what was reported in the period from April to June last year.

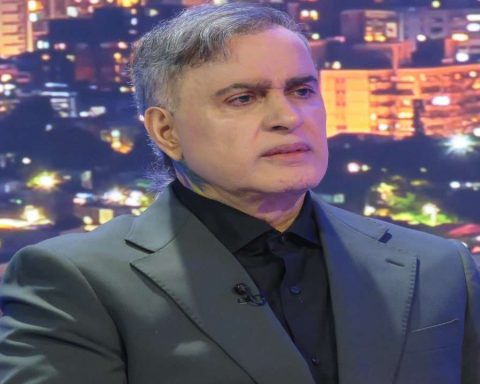

“These results allowed us to reach a historical ROE of 18%, accompanied by historically high solvency and liquidity levels,” said Luis Hernández Rangel, general director of Actinver, in a statement. “The increase in utility was mainly driven by the increase in commissions, highlighting the performance of the fund operator. To the second quarter of 2025, we reached 307 billion pesos in assets under administration, with a growth of more than 72 billion in the last 12 months.”

Actinver He said that his net portfolio grew 7% in relation to the second quarter of last year when it was located at 32 thousand 313 million pesos.

The Bank’s capitalization index was 18.12% – a decrease with 161 base points – and the delinquency index was 3.3%, a decrease of 10 base points.