Due to the proliferation of online betting, which last year moved more than S/ 1,000 million without paying taxes, the Executive saw a collection niche and presented a project to regulate the exploitation of remote games, which will already enter the Plenary of the Congress. In this way, it expects to tax these online businesses with 12%. In this note we tell you the details about the impact of the new regulations.

The measure, which was already approved by the Foreign Trade and Tourism Committee of Congress last Wednesday, June 6, will also impose a Selective Consumption Tax (ISC) 1% for bettors.

According to the head of the Mincetur, Roberto Sánchez, the proposal would allow raising up to S/ 160 million per year that would serve to boost tourism and create more public infrastructure works, as well as promote sports. That is to say, of the 100% collected by the online betting tax, 40% will go to the Public Treasury, another 40% to the Mincetur and the remaining 20% to the Peruvian Sports Institute (IPD).

What would the new regulations be?

The initiative seeks that all companies dedicated to online betting enroll in the Single Registry of Taxpayers (RUC). In addition, they must have a legal representative in Peru; and the web domain of its platform, have the ending “.pe”.

In this framework, if the entities that wish to carry out this activity do not have the respective sectoral authorization, they will be prohibited from entering into advertising or sponsorship contracts.

Another objective is to protect the population through various controls, among which access will be restricted to those under 18 years of age and they will try to avoid addictive behaviors such as gambling addiction by all means.

At the same time, their purpose is that the virtual game does not become a potential place to commit highly serious crimes, such as the financing of terrorism, money laundering, computer fraud, etc.

How would it impact the virtual market?

For the tax lawyer Luis García Romero, a partner at Estudio Muñiz, the project for remote betting companies to pay taxes is good, but those who propose the opinion must explain, with a technical study, the criteria of the amount of the tax rate that will be charged.

“It is important to know what criteria they have taken to define the percentage of 12% or the amount they want to put. Like any tax, there will always be an impact on demand, but sometimes the type of product can cushion that blow.”, the expert referred to this newspaper.

Along these lines, the specialist mentioned that if they do not clarify why the rate they propose is correct, it could end “stoning the industry and behind there is a lot of employment”.

unfair competition

The tax expert also mentioned that another point to consider is that this project could be discriminatorybecause only remote gaming and sports betting companies domiciled in Peru have to pay taxes and foreign ones do not.

“In practice, it could be discriminatory between companies, because if a user takes his cell phone to bet and the local company, which has to take the tax from one side, transfers the payment to its client in some way, then he will opt for a company foreign”, he referred.

Similarly, the Peruvian Sports Betting Association (Apadela)who agrees that a modern regulation be established for this industry, asked that it not be an unfair competition.

“Applying this measure only to companies domiciled in Peru would generate unfair competition by favoring around 100 foreign entities that operate in the country, to the detriment of local industry.“, he pointed.

So he demanded that payment of taxes are the same for all participants in this industry, whether or not domiciledin order to promote fair competition among all local and foreign operators.

What will happen to companies?

According to Apdela, there would be the closure of the vast majority of national bookmakers due to the high tax costs imposed by the regulationas they would not be competitive against foreign bookmakers that do not pay taxes locally.

“The elimination of the income of small businesses that work with the industry to generate additional income would be given“, accurate.

Added to this is the disincentive for more companies to want to operate domiciled in the country.

Reduced sponsorships?

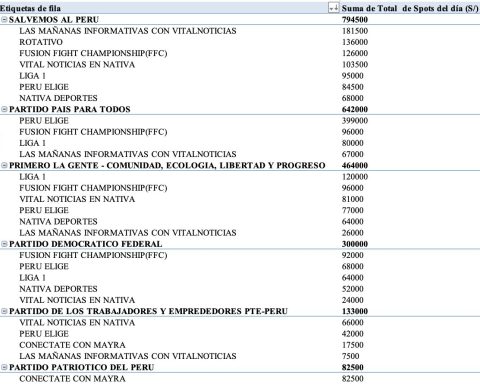

The association explained that the project could generate a significant reduction or even elimination of sponsorships to the national sport.

Along these lines, he added that there would be less or no tax collection from this sector in the country.

RECOMMENDED VIDEO

:quality(75)/cdn.jwplayer.com/v2/media/YErWTZbV/poster.jpg)