Between the fortnight and the second round elections there will be the second Day without VAT in Colombia, Fenalco proposes advance payment of premiums, if this happens, the safety of the workers who collect them is also of concern.

Colombia News.

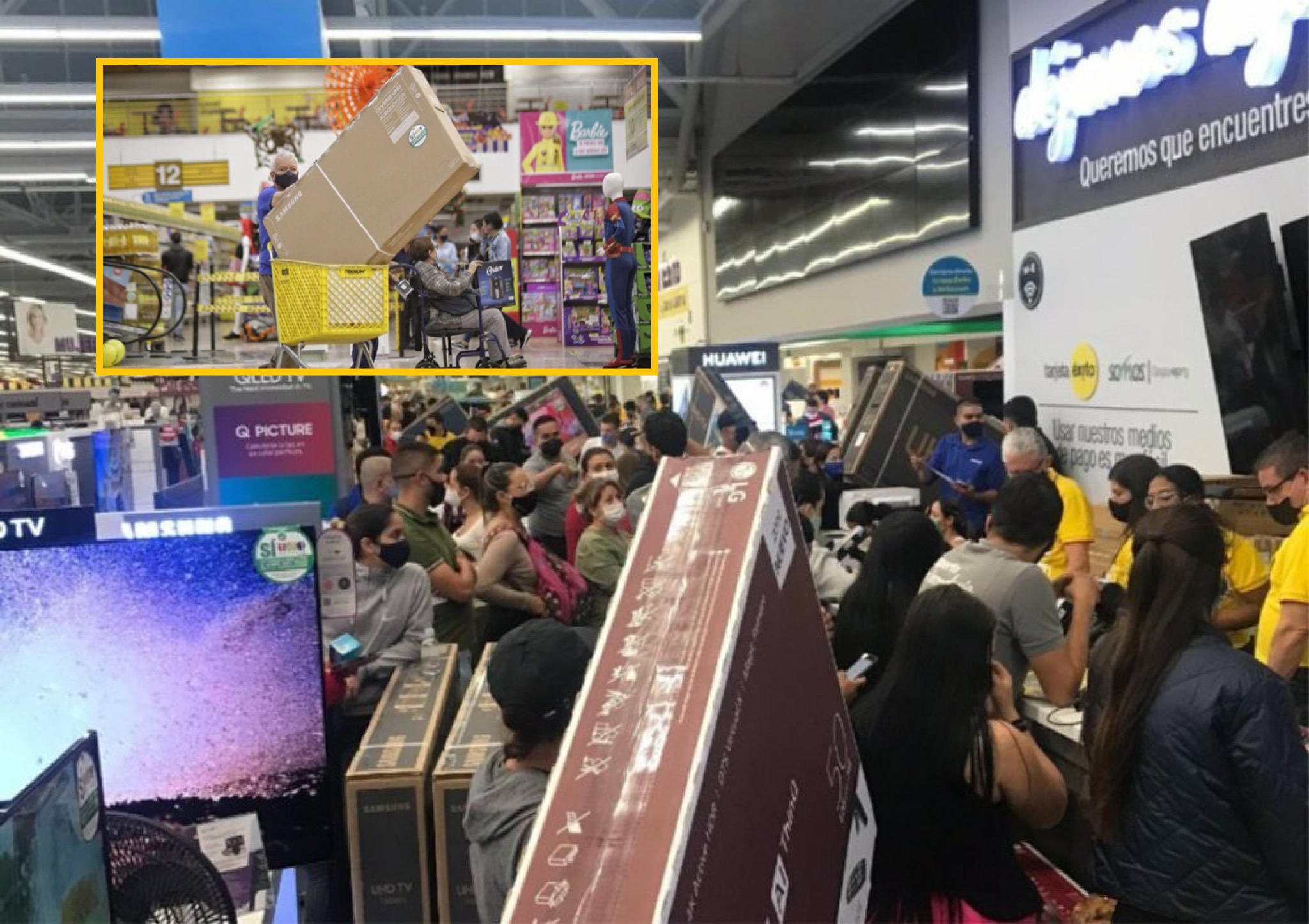

Next June 17, two days before the second round presidential elections, will be the second Day without VAT this 2022, which will apply to face-to-face purchases in commercial or virtual establishments, and from the commerce sector it has been proposed that payment be advanced of premiums.

That July 17, products can be purchased without having to pay the 19% Value Added Tax (VAT).

Although, it will be two days after the fortnight, they propose that the premium be paid so that people can make their investments, also because part of the workers are also paid salaries at the end of the month.

Sincerely, Fenalco

The National Federation of Traders of Colombia (Fenalco), asked the government to advance the payment of that mid-year bonus, but that too, a citizen security issue.

This, because it means extra money moving on the streets.

With a letter signed by the president of Fenalco, Jaime Alberto Cabal, the request was made.

“Taking into account the good results of last year, we ask that the payment of the mid-year premium be advanced a few days, not only to try to mitigate the impact of the inflationary escalation that the country’s economy is experiencing, but also so that more Colombians can access the benefits of the Day without VAT and eventually advance the purchases of Father’s Day, which was moved to the 26th”, they indicated.

However, this may be a voluntary option, according to the president of the organization, who invites the business sector to join his proposal.

They propose to advance the payment of the June premium to take advantage of the Day without VAT https://t.co/iFy8SL6G8W

– Money Magazine (@RevistaDinero) June 10, 2022

What is the purchase limit?

You can purchase up to 3 identical products, without VAT, it will not apply in all establishments or for all products or services.

- In clothing, the limit value of a product can be $760,080, it is also the same value in clothing accessories.

- In any type of household appliances, the maximum value must be $3,040,320, in school supplies it would be a value of $190,020.

- Sports elements can only spend an amount of $3,040,320

- Toys for children a total of $380,040.

Finally, for Goods and supplies for the agricultural sector, there is an estimate of $3,040,320, if it exceeds that limit, the discount is lost.

Day without VAT 2021

Due to the success of the Day without VAT last year, the DIAN added that the UVT for 2022 is $38,004, so the purchase limit on the different products could be modified.

From there also came the decision to propose the advancement of premiums through a letter sent to the Ministers of Finance, José Manuel Restrepo; of Labor, Angel Custodio Cabrera and of Commerce, María Ximena Lombana.