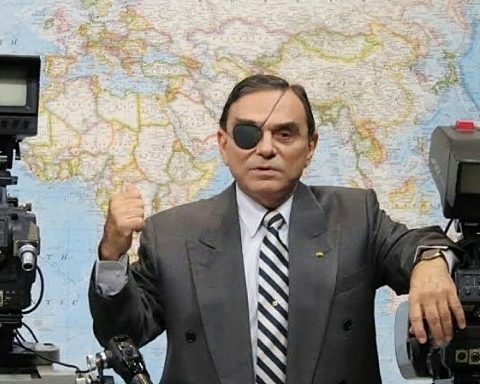

Esquivel was the only member of the Governing Board who voted to keep the reference rate at 4.75%.

“Getting too far ahead of our own rate normalization process could reduce future space and could lead to an unnecessary restrictive position in the near horizon. In addition to being ineffective and inefficient, rate increases could also be counterproductive,” Esquivel said, agreeing. with the Minutes of the meeting published this Thursday.

The deputy governor explained that central banks face inflationary pressures, but most have chosen to maintain the monetary stimulus, recognizing the inability of the tools available to combat them.

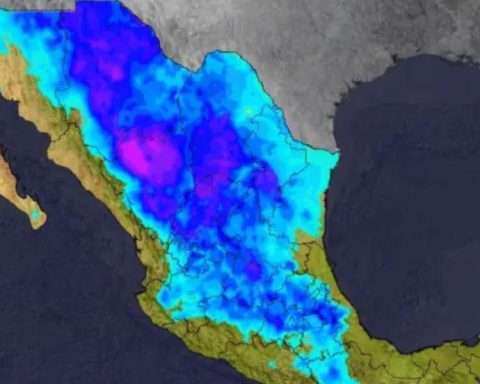

In addition, he stressed that inflation has a global origin, so the rest of the economies follow a similar process. In the case of Mexico, it stands out from other countries for having maintained fiscal discipline, which releases pressure on the exchange rate and the sovereign risk premium.

“This macroeconomic balance gives us a space that other emerging economies do not have and that has not been used,” explained Esquivel.

The Minutes detail that the members of the Governing Board continue to consider that inflation shocks continue to be mainly temporary, although they see an uncertain horizon.

“They have impacted a wide range of products and their magnitude has been considerable, increasing the risks for price formation and inflation expectations. For this reason, it was considered necessary to continue strengthening the monetary stance, adjusting it to the path required for inflation converges to its target of 3% within the forecast horizon, “according to the minutes.