The benchmark S&P 500 index for wall street It was down 20% on Friday from its intraday high on Jan. 4 as investors sold stocks amid concerns about whether the Federal Reserve will be able to effectively fight inflation without causing a US recession.

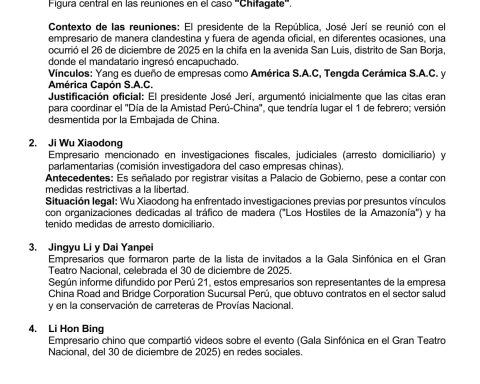

A close of more than 20% below January’s all-time high would confirm that the index is in a bear market for the first time since the 2020 Wall Street crash triggered by the COVID-19 pandemic.

At 1409 GMT, the Dow Jones Industrial Average was down 328.41 points, or 1.05%, at 30,924.72; the S&P 500 fell 48.75 points, or 1.25%, to 3,852.04 units, and the Nasdaq Composite fell 184.47 points, or 1.62%, to 11,204.03 units.

Disappointing forecasts from major retailers Walmart Inc and Target Inc rattled market sentiment this week, adding to evidence that rising prices have begun to hurt the purchasing power of US consumers.

The S&P 500 and the Nasdaq are headed for their seventh straight week of losses, their longest losing streak since the end of the dot-com bubble. The Dow Jones is on track for its eighth consecutive weekly decline, the longest since 1932, during the Great Depression.

Traders are assuming the US central bank will raise interest rates by 50 basis points in June and July.