The progress in financial inclusion represented by the fact that there are 33.2 million adults with at least one financial product, and 27.8 million with products that they actively use, shows that among other advances, the financial system has improved in innovation with products and services .

(Impacts that Banrep’s rate hike has had on deposits).

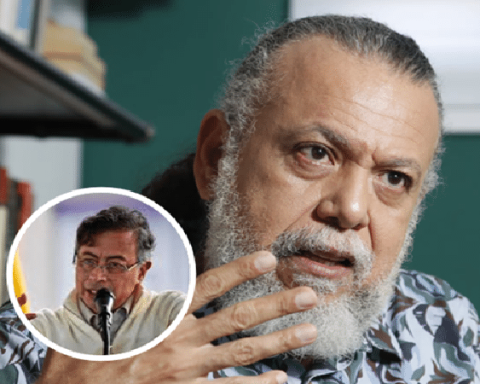

According to the most recent data from the Asobancaria Sustainability Report, they show that financial entities have invested around $700,000 million in this matter in the last five yearssaid Hernando José Gómez, president of Asobancaria at the opening of the 12th Congress on Access to Financial Services and Means of Payment.

In addition, Gómez highlighted that digital channels are preferred by financial consumers to carry out their operations. “In 2021, 48% of the amount traded moved through digital channels, 16 points above the amount of operations carried out in physical channels, which only reached 32%”, he explained.

(Abc of the project that seeks to end the so-called ‘drop by drop’ credit).

Gómez pointed out that closing gaps continues to be a priority issue for the financial system, especially in relation to the rural population, women and MSMEs.. To improve the situation of rural populations, Gómez indicated that the development of mobile and digital correspondent models should continue to be promotedwhile in order to reduce gender gaps, she spoke of the need to have savings and deposit products that are more in line with their reality.

BRIEFCASE