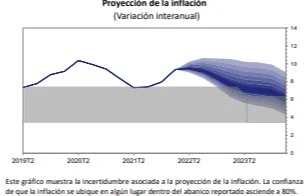

The technicians of central bank (BCU) expect inflation enter the ceiling of the target range (6%) towards the first quarter of 2024, that is, in two years, according to the latest Monetary Policy Report (IPOM) for the January-March quarter. Since September this year, the ceiling of the official inflationary range will be reduced by 1 point and will remain in a band of 3% to 6%.

Inflation projections present an acceleration at the beginning and a downward trajectory from the third quarter of this year, to culminate in 6% at the end of the Monetary Policy Horizon (HPM) of 24 months.

IPOM

Inflation expectations for 24 months have shown an increase compared to previous quarters. The summary indicator of the three methodologies monitored by the BCU advanced 57 basis points between December and March, currently standing at 7.8%.

“This sustained drop in inflation over the next 2 years is determined by monetary policy, which reacts to deviations in inflation and activity through increases in the MPR (interest rate), and the consistent framework of coordination of macroeconomic policies. In this sense, adjustments of administered prices compatible with the inflationary goal are incorporated, as well as the results of the 9th Round of Salary Councils”, the report states.

According to the BCU, “the main macroeconomic factors that would contribute to this disinflation process would be the moderate dynamics of the nominal and real exchange rate in the first part of the HPM and a slightly negative GDP gap.”

According to the report, the main risks for inflation “they are associated with global commodity prices maintaining their upward trend, the transfer to prices of the possible advance of salary adjustments due to inflation correction for the month of July and an unfavorable evolution of inflation expectations. There is also the risk of greater imbalances in the region, leading to a faster increase and greater volatility of the exchange rate, with a direct impact on tradable inflation and possible second-round effects”.

The BCU Board of Directors decided to increase the interest rate by 125 basis points (1.25%) to 8.5%, after the meeting of the Monetary Policy Committee (Copom) on April 7. This increase was higher than anticipated in previous meetings and responds to the international context of higher inflationary pressures, taking into account the local economic situation. In turn, the BCU anticipated a new increase in the interest rate in the next session in May and hopes that in the following meetings this The process continues, with the objective of aligning inflation expectations two years from now with the target range of 3% to 6%.

The balance of risks has an upward bias, given the greater probability that inflation will be above the most probable value (mode of the distribution) than below it. Additionally, the trust assigned by the fan chart for inflation to be within the target range at the end of the HPM is similar to that of the previous Copom (33% in this report, 36% in the previous one).

IPOM

GDP would grow 3.6% in 2022-2023

In the baseline scenario, the expected evolution for the level of activity assumes an average growth of 3.6% in 2022-2023. “This growth would be determined mainly by a greater dynamism of private consumption in the face of the expected recovery in the wage bill and net exports in the face of favorable external conditions,” says the IPOM.

For the BCU, the “main risks regarding the level of activity refer to the materialization of more persistent or deeper effects of the pandemic, both domestically and internationally, and to the development of the Russia-Ukraine conflict. Likewise, another latent risk is the region, which maintains macroeconomic imbalances”.

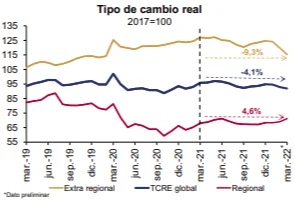

Exchange rate

During the first quarter of the year, the global real effective exchange rate (REER) showed an average appreciation of 0.9% (preliminary March) compared to the previous quarter (October-December). This behavior was determined by an increase in prices compared to partners from outside the region, while a relative reduction was recorded compared to regional partners, especially Brazil, according to the report.

IPOM

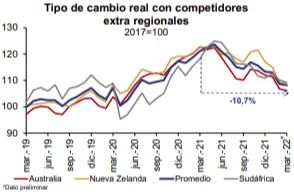

The IPOM indicates that the bilateral real exchange rate (REER) with respect to competing countries for Uruguayan products “has been showing a downward trend since mid-2021. The January-March average (preliminary March) appreciated 4.6% compared to the last quarter of 2021. Meanwhile, in the year-on-year comparison, an appreciation of 10.7% is observed. In both comparisons, the increase occurs compared to the three countries included in this indicator.”

On the other hand, the bilateral REER with respect to Uruguayan competitor countries has been showing a downward trend since mid-2021. In the January-March average (preliminary March), it appreciated 4.6% compared to the last quarter of 2021. In Therefore, in the year-on-year comparison, an appreciation of 10.7% is observed.

IPOM

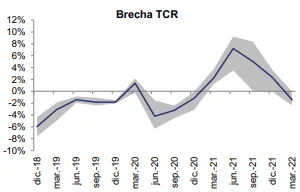

For his part, the RER of fundamentals (RERf) estimated by the technical services (average of three methodologies) depreciated in the quarter as a result of the deterioration in the terms of trade and lower spending relative to GDP. In this way, the gap between the REER and the REERf decreased and stood at around -1.4% for the average of the estimates, according to the IPOM.

IPOM

Finally, the indicator Unit Gross Surplus (IEBU), which is available with a longer lag, presented a 2.7% increase in the moving quarter average to January 2022 in the trend-cycle measurement. This rise in the margin was explained by an increase in export prices and a decrease in costs, particularly of raw materials. For its part, in the comparison compared to January 2021 showed an increase of 10%.

While, it is “expected that as of 2023 the exchange rate will depreciate at a higher rate than that forecast in the previous reportin a scenario with higher increases in international interest rates”, while the inflationary shock from international prices is disarmed.