Page Seven / La Paz

Natural gas consumption in the domestic market skyrocketed as of 2006, but production began to decline since 2015 and now the balance between supply and demand is fragile, so the country began to breach the sales contract with the market Argentinian.

The official data of YPFB Transportes and compiled by the Jubileo Foundation reveal that in 2006 the commercialization reached 4.29 million cubic meters per day (MMmcd) and in 2018 it reached a peak of 13.55 MMmcd, due to industrial and electrical consumption, the increase in home gas connections and the conversion of vehicles to Natural Gas Vehicle (NGV).

In 2020 it was reduced to 8.2 MMmcd and in September of this year a recovery of up to 12 MMmcd is reported, according to data from YPFB, the Ministry of Hydrocarbons, processed by the Directorate of Hydrocarbons and Mining of the Government of Santa Cruz.

Natural gas production in 2015 reached 61.33 MMmcd, in 2019 it fell to 45.36 MMmcd and in 2020 it reached 43.52 MMmcd. As of July this year, it reaches 46.31 MMmcd, reveal the figures from the Ministry of Hydrocarbons.

The President of the State, Luis Arce, in his message to the Legislative Assembly, pointed out that the volume produced increased this year by 4.4% and that the production of liquid hydrocarbons went from 41,600 barrels per day to 42,900 barrels per day, which represents a growth of 3.1%.

Data from the Santa Cruz Hydrocarbons Directorate show an average volume delivered for commercialization of 45.30 MMmcd between April and September.

19.51 MMmcd were exported to Brazil to fulfill the contract with Petrobras and to Argentina 13.33 MMmcd. If the internal market of 12 MMmcd is added, the balance between production and demand is fragile.

For Hugo Del Granado, an analyst in the sector, the country’s situation in terms of gas production is critical. “It is a crisis situation, the product of years of delay in exploration tasks, which is manifested in the impossibility of producing more,” he lamented.

He added that the Arce government has been in office for a year and there is no discovery of reserves, nor a way to be optimistic about the future.

Added to the fragile situation is the drop in production from the Margarita field by 2 MMmcd and the breach of volumes agreed with Argentina.

Del Granado maintains that the growth of internal gas consumption is growing because there is greater demand for domestic gas networks, conversion of cars to NGV, a requirement of the urea plant.

Álvaro Ríos, former Minister of Hydrocarbons, said that there will be no shortage of gas in the domestic market in the immediate future, but there are problems with gasoline, which depends on imports for 36% and 71% for diesel. “If nothing is done in 2030, gas will have to be imported, but for the next three years, 20 MMmcd must still be exported to Brazil and seven to five MMmcd to Argentina.

Most of the gas production depends on the supply of the Margarita, San Antonio and Incahuasi fields, which are the main deposits. Of the others, the offer is less.

Mauricio Medinaceli, former Minister of Hydrocarbons, said that the lack of production is not something that can be solved with a couple of adjustments. “Those of us who periodically follow the sector already had this ‘surprise’ years ago. And it was a matter of seeing the numbers. Bolivian gas production until 2014 was all joy and rejoicing -although there were already negative signs-, production increased and statistics flowed like water in a spring. Then, as of 2015, the situation begins to stagnate and then decline ”, he specified in an analysis of the sector on his blog.

He added that this situation is reached because the entire oil and gas system since 2005 was configured to harvest and not sow. In this context, the country has one of the highest royalty and tax regimes in the world; YPFB’s performance was misguided and there was little control by the National Hydrocarbons Agency.

There were also failed and expensive explorations, a messy legal framework, subsidized fuel prices, no funds were created for the “lean season” and the Incentive Law did not work.

According to Medinaceli, a tax system that is adjustable to the reality of each field is needed, that the rules of the sector are defined by law and not by ministerial decrees or resolutions.

On the other hand, according to Medinaceli, when producers sell gas to the domestic market (electricity sector, distribution networks and urea plant), the profit is negative.

“If we subtract transportation, taxes, royalties and costs from these gas sales prices, the results are absurdly negative. So there is no incentive for producers to sell to our market: a reasonable profit. Therefore, it is necessary to gradually eliminate the subsidy on the price of natural gas that is sold to the domestic market. It hurt? Yes, but I think you should do it ”, he suggested.

The president of the Departmental Chamber of Industry, Pablo Camacho, reported that at the moment they do not face problems in La Paz in terms of gas supply and is permanently coordinating with YPFB.

- The sea of gas

- Forecast The President of the State, Luis Arce Catacora, highlighted that the investment to finalize the exploration plan for the Bolivian Fiscal Oil Fields (YPFB) for the period 2021-2025 considers an amount of 1,550 million dollars.

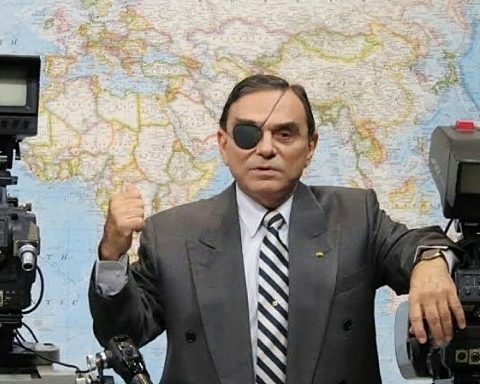

- Words Despite the fact that in August 2019 the country was already suffering a drop in gas production, Luis Sánchez, former Minister of Hydrocarbons, even pointed out that “a sea of gas” was discovered in his administration, but that it is not visualized or not you want to visualize. He assured that the country produced 59 million cubic meters per day (MMmcd) and that there was a lack of understanding between production and nomination.