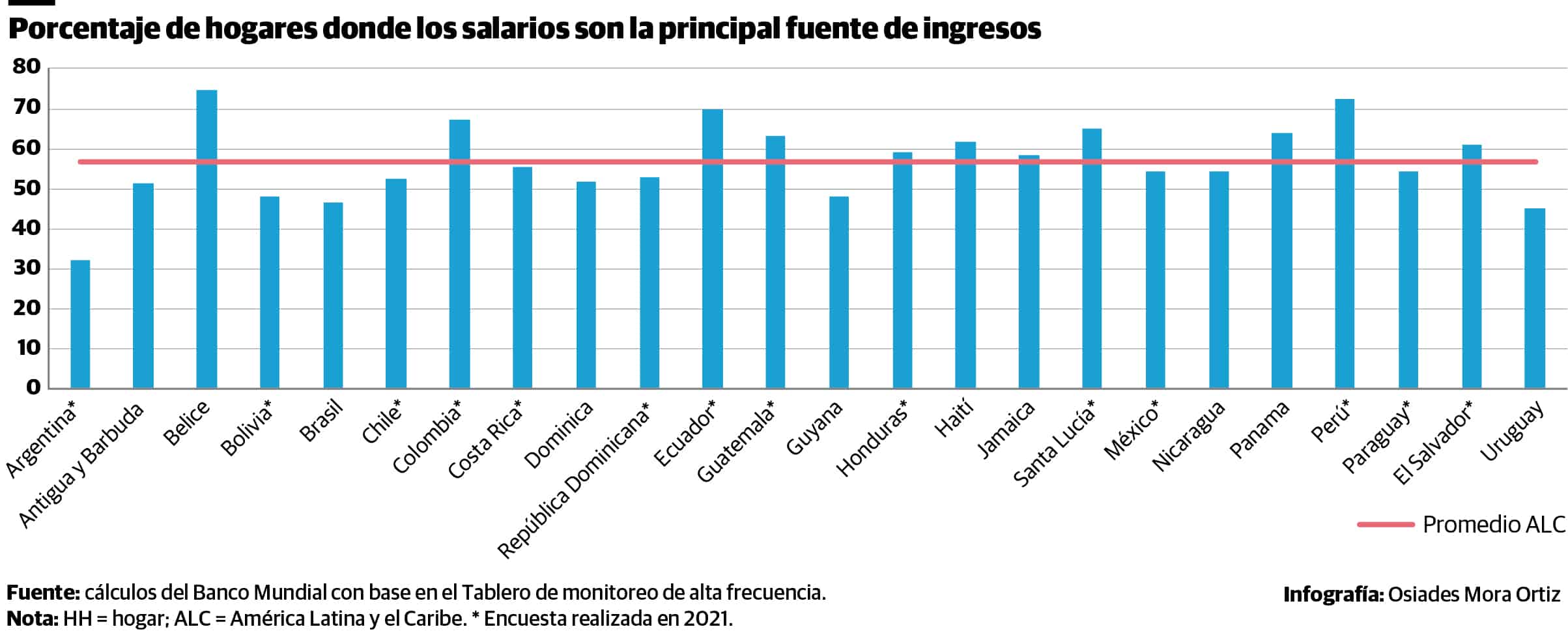

Around 54% of Dominican households depended in 2021 on their wages as the main source of income, close to the regional average of around 58%.

The data is contained in the most recent semi-annual report of the world Bank: “Consolidating the recovery: taking advantage of the opportunities of green growth”, recently released, which also indicates that, on average, more than half of households in Latin America and the Caribbean reported in 2021 a drop in their income since the start of the pandemic past year.

Argentina was the country in the region where its population reported less dependence on wages as the main source of income.

“The possibility of an increase in the default rate in both sectors could harm the financial sector, given that loans to non-financial companies and households on average represent 48 percent of bank portfolios,” highlights the report. world Bank in your report.

However the Inter-American Development Bank (IDB) indicates that in countries such as Haiti, Belize, Panama, Mexico and the Dominican Republic, loans from relatives or friends are especially relevant, equaling or even surpassing the financial system in importance.

Note that for 2018, in the Dominican Republic, more than 90% of households declared they had no financial burden, or paid a percentage less than or equal to 10% of their income if they did.

“In countries such as Belize, Costa Rica, the Dominican Republic and Panama, households where the head of the family does not work or works in the agriculture and fishing sectors are more likely to be over-indebted,” indicates the IDB in the study “In Search of of better indebtedness conditions for companies and households”.

During the economic crisis that generated the pandemic of COVID-19, the countries of the Central American region, Panama and the Dominican Republic implemented financial measures to mitigate the effects on credit.

The IDB indicates that 20% of households in the Dominican Republic that indicated that they have received payment flexibilities due to COVID-19 responded that without them they would not be able to pay part or all of the loan.