“The reality of inflation is calling for more monetary medication,” said Alfredo Coutino, director for Latin America at Moody’s Analytics.

Monetary policymakers had signaled slower hikes to come after the sharp hikes earlier in the year. Chile has raised its benchmark interest rate by 650 basis points since the middle of last year. Brazil has raised the interest rate to 11.75% from the historical low of 2% last March.

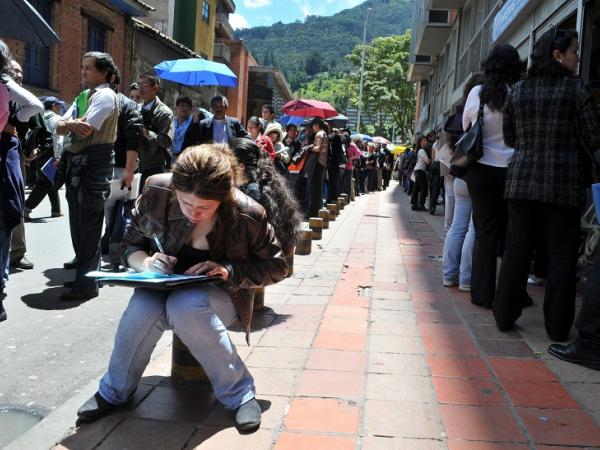

This has so far failed to curb prices, as annual inflation has also soared, driven by food prices and fuel costs, a volatile mix that is sparking angry protests in Peru and forcing political leaders to take evasive action.

restrictive cycle

William Jackson, chief emerging markets economist at Capital Economics, said higher-than-expected inflation rates support the view that regional central banks will have to raise interest rates more than expected.

“It reinforces our view that the tightening cycle will go beyond the path implied by the latest central bank guidance and analyst consensus,” he wrote in a note.

Following the latest inflation data, Brazilian interest rate futures rose across the board with economists signaling that next month’s expected rate hike may not be the last of the cycle, as the bank had previously suggested. .

In Argentina, where annual inflation is above 50% and is expected to rise further, the central bank is likely to raise interest rates again in April, a source at the entity told Reuters, after three hikes. consecutive this year.

“There should be a further upward adjustment this month,” the person with direct knowledge of the discussions said, adding however that the hike would likely be limited to 150 basis points to avoid slowing economic growth.

inflation is back

The headache for policymakers in Latin America, one of the world’s top producers of commodities from copper to corn, comes at a time when a global supply contraction is heating up prices around the world. .

Almost 60% of developed economies now have annual inflation above 5%, the highest proportion since the late 1980s, while it exceeds 7% in more than half of the developing world.

This is rattling governments from Sri Lanka to Peru, which has been hit by angry protests in recent weeks against rising fuel and food prices. The central bank has responded by raising interest rates to the highest level since 2009.

And in the region’s second largest economy, Mexican consumer prices rose in March at a pace not seen since 2001, and economists now expect more interest rate hikes.

However, the fight to lower prices can be a long one.

The director of the Bank for International Settlements, Agustín Carstens, warned earlier this week that the world is facing a new era of inflation and higher interest rates as the deterioration of ties between the West, Russia and China and the consequences of COVID push back globalization.

“Inflation is back,” said the BIS central bank group.