Activity in the commerce and services sector had a slight rebound in the third quarter of 2021, after nine consecutive periods with downward results. Global sales in the sector had an interannual variation of 0.2% in real terms, according to the latest survey of the Uruguayan Chamber of Commerce and Services (Ccsuy). It is the first time that a year-on-year increase has been registered since the second quarter of 2019.

The significant increase in sales in various items explains the positive result of this third quarter. In the service sector, the three items surveyed showed strong improvements in their sales, hotels (13.4%) and restaurants and confectioneries (13.7%) continued to grow, as in the previous quarter, while aTravel agencies managed to reverse the sustained decline that began in 2020 with the arrival of the pandemic, with a sales increase of 17.9% in this period.

Source: Ccsuy and Equipos Consultores

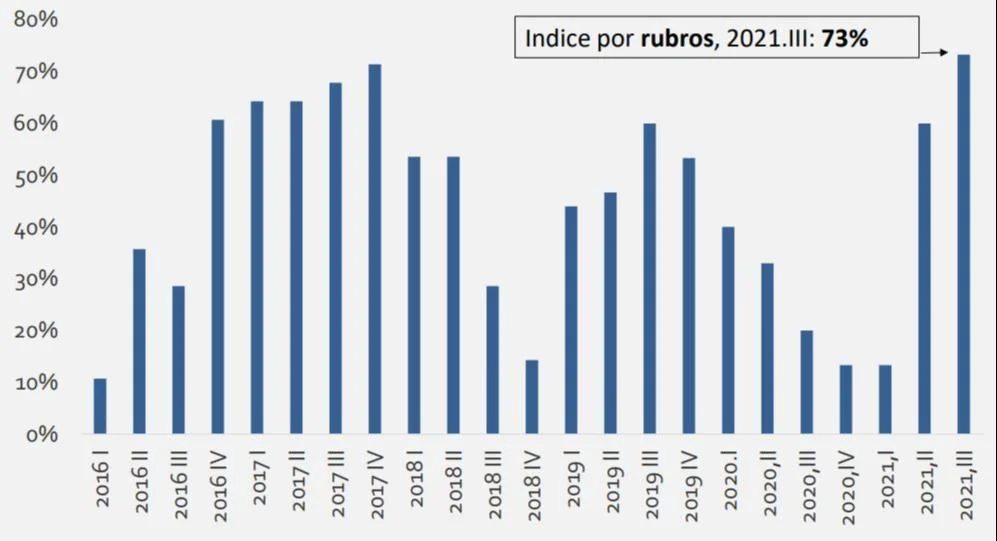

Real year-on-year change in sales

In the commerce sector, Most of the items presented positive variations, highlighting the good performance of IT (12.4%) and convenience stores (17.1%). In the case of the Clothing item, it would seem that it manages to consolidate a growth phase since it is the second quarter with growth levels of its sales close to 10%. For its part, Toys, although it continues to achieve positive variation rates in its sales volumes, does it at lower levels. On the contrary, sSupermarkets (-4.6%) and household appliances (-6.1%) continued to register year-on-year falls, although to a lesser extent than the previous quarter.

In this sense, the diffusion index by item reached levels 73%, that is to say, of the total of the 15 items surveyed, 11 of them registered positive variations in their real sales levels during this quarter, explained especially by those items that managed to enter a growth field. On average, during 2020, the diffusion index by item was 25%, which means that only 4 of the 15 items had managed to increase their sales levels in the year-on-year comparison.

Diffusion Index by category

Future expectations improve

Little by little, the effects of the pandemic on activity are beginning to be forgotten and expectations in the sector begin to improve, be it for growth in activity, profitability, hiring of personnel and investments.

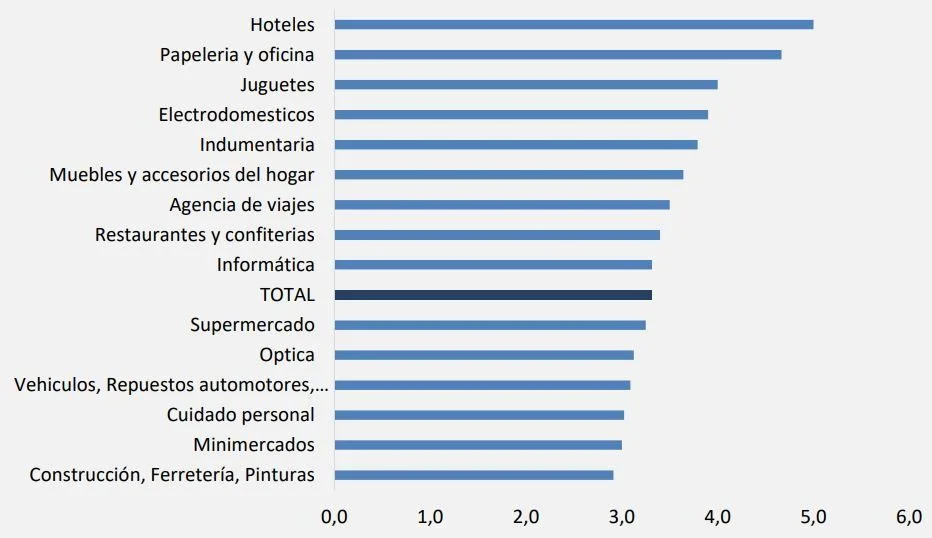

In that sense, the expected period of impact on average of the activity of companies due to the covid-19 (3.3 quarters), showed a decrease, although moderate, with respect to the result of the second quarter of this year (when it was 3.7 quarters ). This means that while in the report at the beginning of the year, companies in the commerce and services sector expected a return to normality only by the end of 2022, currently companies expect that this relative recovery can occur in mid-2022.

Expected period of impact on the activity Third quarter 2021 – In quarter

Regarding the behavior of profitability levels in the coming year, companies are in an area of significant optimism. In the commerce sector, 66% of the companies in Montevideo expect their profitability levels in the next year to be better and / or much better, while in the Interior this value takes figures of 71%.

In the case of services, in Montevideo, 75% of the surveyed companies expect an improvement in their profitability at 12 months, while in the interior it takes values of 85%. In relation to shorter-term expectations, 50% of companies expect their sales to register a year-on-year increase in the next quarter, while 36% state that they would remain and 11% that they would decrease.

Regarding the hiring of personnel, In Montevideo’s commerce sector, 14% answered that they believe it will increase, 85% that it will remain and only 1% that it will decrease.. In the interior the situation is similar: 12% believe that it will increase, 84% that it will remain and 3% that it will decrease. In the area of services, the outlook for the hiring of new personnel is more optimistic in the interior than in Montevideo: While in the capital 12% believe that it will increase, 72% believe that it will remain and 16% believe that it will decrease, in the interior 29% believe that it will increase and 71% that it will remain. There is no percentage of companies that believe it will decrease. This difference could be explained by the imminent arrival of the summer season, which implies an increase in seasonal work in various tourist departments in the interior of the country.

Telecommuting and electronic commerce

Regarding the analysis of the teleworking scenario among companies 15% of those surveyed stated that they currently carry out some type of telework. By line of activity, IT companies stand out since 60% of them established teleworking.

Regarding e-commerce, 29% of the total number of companies that make up the sample said they had an online sales channel, a figure that is maintained compared to previous periods. Regarding the type of online sales channel, 41% established to do it through their website, 33% through Social Networks, 20% through Mercado Libre and 7% through Orders Now / Rappi. Likewise, in real terms, for the total number of companies that have these digital sales channels, weighted according to employed personnel, online sales increased 25.3% in the third quarter, in the year-on-year comparison. It also stands out that, in the second quarter of this year, sales had grown 20.4% in real year-on-year terms.