Scams, information theft and accounts ’emptied’ through text messages and WhatsApp chains have skyrocketed, almost 40 million are taken from a Caleño in a bank.

Cali News.

In Colombia, complaints, complaints and claims for credit applications, mobile phone plans have skyrocketed; Internet and other services that third parties have taken, stealing information from people when they enter links, call numbers that arrive by text message, WhatsApp or answer deceptive calls.

In addition, they are taking out credits, products and services in their names.

Part of those scams and identity theft; Money, and other data, are made by entering emails, accounts, even scamming others with fake WhatsApp profiles.

They send messages to contacts, and end up asking for money, many run with the luck that they make transfers and money orders.

Others are more cautious and verify before responding, and do not fall into the trap.

“Dear user”

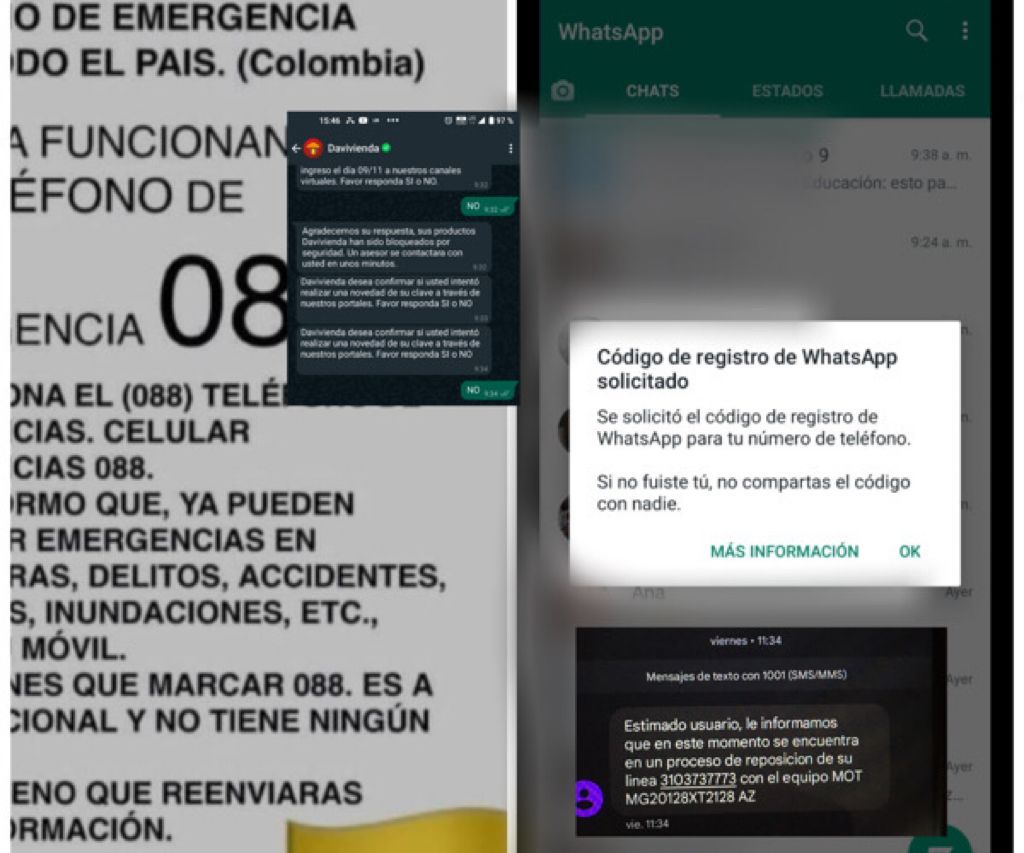

Óscar received a text message that said from Claro, in which they said: «Dear user, we inform you that at this moment you are in the process of replacing your line 310373 **** with the Moto G20 team in the city of Bogota”.

The user was without service over the weekend, so given the situation and since Claro did not answer, he decided to change the passwords for everything on his cell phone.

On Monday when they contacted and finally answered them, the operator told them that they had not done any process with their line.

They were trying take out money

And indeed, the reports began, among other things, attempts to get money in his name in Davivienda.

With this bank, he could not change passwords “because he did not allow him to do so over the phone.”

So throughout the weekend, they were trying to access their mail, and reports were coming from Davivienda.

On the same Monday, when the line was active, “they answered calls and were online on WhatsApp, they began to access the Gmail account four attempts and they were unsuccessful.”

Hours later, the most delicate situation arrived, the disbursement notification arrived in the mail and I will pay four loans worth almost 40 million for mobile banking ».

Given this, they immediately called the bank ”,“ they told him that the money was already in the account ”and when he realized that it was a robbery,“ they managed to freeze all the money ”.

Even when the process to freeze the money had already been done, “they tried to enter the bank more than 10 times until they succeeded but they can do nothing.”

They even went to ATMs to try to withdraw and make movements with the money.

In this case, the user had not done anything with the message that he received, so it is presumed that he just received it, his data had already been leaked.

Millions of data in digital databases

The other dilemma of citizens is that their telephone numbers, personal data and even their identity card, roll in databases of banks, businesses, warehouses and telephone operators.

Who controls how those millions of pieces of data are handled?

- Why, if your line belongs to one operator, do they call you from another to offer you products and services?

If this happens, you must remember how and to whom you give your information, when you go down the street and they ask for a survey, or enter to ask for a service. The so-called ‘fine print of the contract’.

The so-called marketing and commercial strategies are a “double-edged sword” warn specialists, in many entities they do not give information if a record is not made first with at least basic data and the signing of a “responsibility and acceptance” form.

There, your data is already there, and it remains even if you are denied credit, or the product or you finally do not access it.

In addition, the other problem is the leaks to public entities, company pages and social networks.

Scams and fake chains

While the other dilemma, they are social media and text messaging: from he won a car with Saltín Noel, to “we want to offer you a better plan, can you update your data?”, and many do not counter-question, but give them.

These types of messages are scams.

Despite the constant complaints about this type of scams and thefts, few are the captures, without being difficult to trace.

The main call of the authorities is that the citizens try to verify the messages that reach them, with their banks, operators, warehouses from where they are supposedly called.

Do not give your identification number, or address or respond if you have not been able to verify that it is the official entity that is communicating with you.

For example, most transactions are made with a general code through money order companies, or an official account in banks, not depositing to individuals.

Unless it is a loan with individuals and you already have that clear.

In those cases, for example, it applies is to pay the fees.

Stay alert

If you have not requested changes to the number, plan on your phone, or any product in a bank, you do not have to provide personal information.

If you are from an entity that calls to offer you other products, different from the ones you have, they must tell you what your personal data is and you must decide whether to confirm it by phone or not.

He won a car for buying cookies, how many continue to fall for this scam?