The first quarter of the year closed without livestock prices taking their foot off the accelerator. There is agreement on the persistent firmness of the market and the limited supply of well-finished cattle. The high volumes of work continue to surprise.

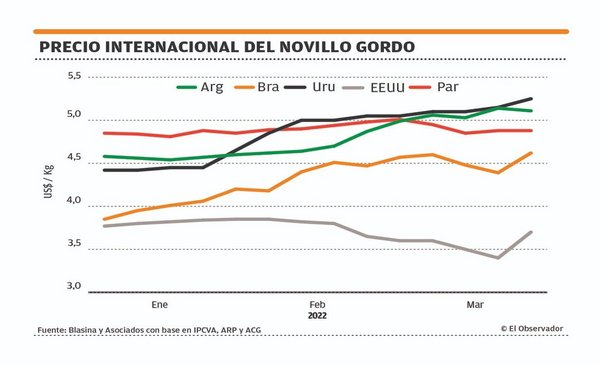

Local prices gained a few cents compared to last week and are consolidated above the Argentine and Brazilian markets.

The steer continues to set records in Uruguay, with peak values that cross US$ 5.30 per kilo meat for batches that are exceptional in quality and volume. “It’s a very fluid and demanded market,” said Christopher Brown, director of Agro Oriental.

In Argentina the steer reaches US$5.11 per kilo and in Brazil US$4.62, with downward pressure in this last week.

In the local market, the special fat cow is priced between US$4.90 and US$5 per kilo. In specific businesses this value is exceeded. The heifer, with a somewhat heavier market compared to the cow and the steer, is between US$5 and US$5.10 per kilo.

The work does not loosen

The slaughter was 54,971 cattle in the last week and the data for next Monday will surely confirm a new historical record for March. As of March 26, it added 213,238 heads. Crossing 239,336 –reached in March 2010– a new maximum for the month will be marked.

“As long as they maintain these slaughter volumes, the market should remain firm, tending towards a balance in the coming weeks,” the operator estimated.

Global appetite for beef

The global appetite for beef explains this industrial dynamism, with China demanding despite an adjustment in values that has been taking place in recent weeks. Europe and the United States remain firm. This is seen in the export price that remains at historical highs.

The Average Income from Exports (IMEx) was located at US$ 4,927 per ton last weekand so far this year it reaches US$4,901, a jump of 29% compared to US$3,799 in the same period of 2021.

In addition to the rise in prices, there has been an increase in the volume exported, with shipments totaling 128,057 tons so far this year, 21% above the 105,949 a year ago..

In recent weeks, the relationship between the farm and the export price reached its highest since October of last year. So far this year, it has been steadily rising above the historical average.

john samuel

The price of the calf is also very firm, as has been seen in the auctions on the screen.

In this hot livestock market, the replacement seeks to get within range, with strong buying interest and outstanding values in the Uruguay Screen auction this week. The calves averaged US$3.01 per kilo, in a third consecutive auction above US$3. The average was 25% higher than that registered in March of last year, when the calves averaged US$2.41. With a large participation of heavy lots, the bulk average was US$ 516.

Wintering cow values, at an average of $2.15, were up 3.6% from the previous auction, and 47% from March 2021.

In the sheep farms there is not much supply, there is avidity to buy and good demand. Prices are confirmed. Businesses exceed US$4.53 per kilo for lamb, US$4.45 for lamb, US$4.06 for capons and US$4 for sheep.

So far this year, the slaughter of sheep is 5% below the total for 2021 at this point, with 320,248 heads, adding the 21,249 of the last week. There has been an increase in the participation of sheep and a decrease in that of lambs.

The export price of sheep meat returned to the path of US$ 5,000 per ton and it is paired with beef, something unusual. Last week it averaged $5,570, and so far this year, $5,116, up 8.5% year-on-year.

Contrary to what happens in beef, the volume exported has a setback: 5,415 tons this year as of March 26 after 6,403 at the beginning of 2021.