The Ceres Leading Index (CLI) increased 0.2% in March and completed three months of consecutive growth, indicating that the trend of economic activity in the first quarter of 2022 went up. After exceeding the pre-pandemic level of activity, the Uruguayan economy continues to increase in the first quarter of the year.

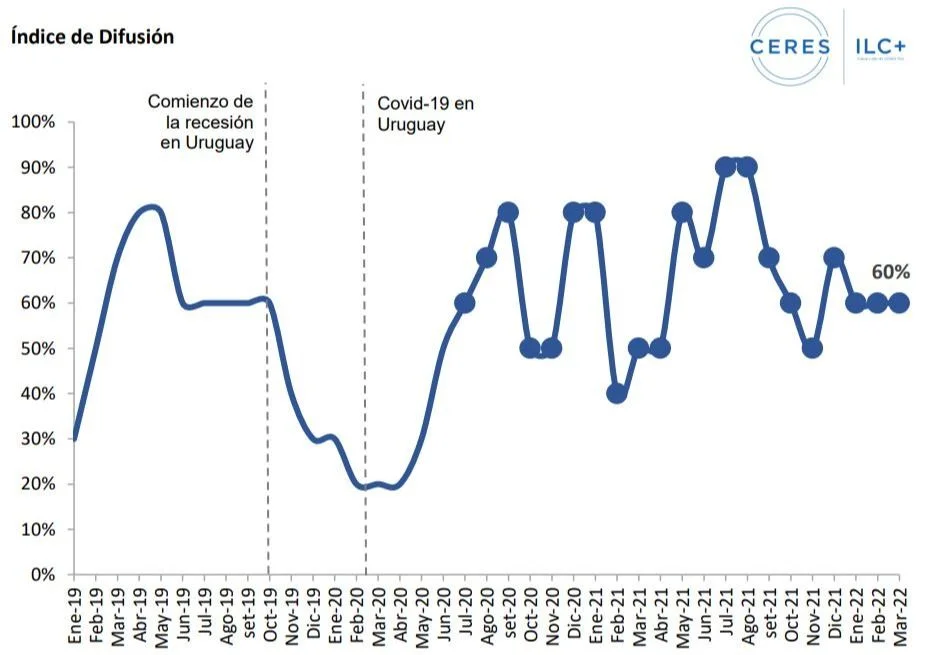

In addition, the Diffusion Index in March was 60%, Indicating that more than half of the variables that make up the ILC registered positive rates in the month.

The Diffusion Index is complementary to the Leading Index and measures the breadth of the support base of its monthly movement, since it considers the proportion of the ILC variables with positive rates in each month.

Agriculture continues to be the engine

According to him Center for the Study of Economic and Social Reality (Ceres), The agricultural sector is one of the most thriving in the economy. In that sense, they stand out very good prices both at the level of cattle raising like farming driven by a strong international demand and global supply problems encourage high production levelsin the historical comparison.

Currently, the livestock sector is facing historically high placement prices; the market has a floor US$ 5.1 for steers and the export ton is above US$ 5 thousand. From the sector itself, it is understood that this price level It is here to stay, beyond the current geopolitical situation.

By the end of 2021, analysts considered that in 2022 the work would return to normal after a record year. However, compared to 2021, in the first weeks of 2022, there was an increase of 13.9%. For its part, it is projected that the cattle stock will fall by 400 thousand headsa fact that is understood logical based on the work dynamics that have existed in the last three years. As far as sheep meat is concerned, High sales prices are observed (year-on-year increase of 6.5%), but with a drop in slaughter level, compared to 2021 (-2.4%).

Pulp exports in February in dollars were 23% higher than February 2021, fully explained by the increase in the export price. Meanwhile, sales of products dairy products in February, were 61% higher, in year-on-year terms. exports of wood were 42% higher.

The impact of the conflict between Russia and Ukraine

The uncertainty regarding the war between Russia and Ukraine with what it entails regarding the global supply of grains, generates an increase in the price of these. the price of wheat is close to US$ 380 per ton, rapeseed above US$700 and the soybeans are above US$600.

In turn, beyond high placement prices, a good level of crops is expected, unless the rains complicate this scenario. Referents of the sector project that there may be a record in the yield of soybeans, with a production of more than three million tons. At the same time, it is also foreseen a record in corn production, above 900 thousand tons.

For its part, the war between Russia and Ukraine also brings bad news since fertilizers are having a very significant price increase that can discourage the favorable price effect that grains have. For example, urea in March 2021 it cost US$393, and it is currently trading above US$1000. Ammonium sulfate, along the same lines, had an increase in the last year of 10 times its value. So far there is no significant shortage, but producers speculate whether to buy now or later based on the price of the different inputs.

In seasonally adjusted terms, cattle slaughter decreased 2.5% in February compared to January, and was 23.3% higher than in February 2021. In cumulative terms, In the first two months of 2022, cattle slaughter increased by 19.9%, compared to the same period in 2021. The export of beef in tons decreased in February (-3.6% compared to January, seasonally adjusted), and was 20% higher in year-on-year terms. An increase of 20.2% compared to the first two months of 2021.

The shipment of milk to industrial plants increased 1.8% in February (seasonally adjusted) compared to januaryand it was 0.1% higher than a year ago. In cumulative terms, there a decrease of 1% compared to the first two months of 2021.

Timber export applications increased 5.6% in February compared to Januaryin seasonally adjusted terms, while in the year-on-year comparison are 4.7% below. Cumulative termsthere is a decrease of 6.8% compared to the first two months of 2021.