Solid as a rock, the cattle market in Uruguay is sustained, above US$ 5 per kilo for the best steerswith visits to the plant that do not exceed a week and an export price that remains above US$ 5,000 per ton. Operators point to a price adjustment in China for beef, but so far this has not been reflected in the fat farm market.

Uruguay leads in the region, with the most expensive steer. In Brazil in the last week it was quoted at US$ 4.39 and in Argentina the steer for export reaches US$ 5.03.

The previous week, some refrigerators gave signs of wanting to put cold cloths on the price spike, with lower value proposals, but the market did not validate drops.

This week there have been exceptional sales of up to US$5.20 per kilo of carcass for special export steers and above US$5 for heifers.

The market continues to earn a few cents every week, said Gonzalo Bia, from Rodeos Negocios Rurales.

The axis of business is between US$ 5 and US$ 5.05 per kilo for heavy steers, between US$4.80 and US$4.90 per kilo for the special cow and between US$4.90 and US$5 per kilo for the heifer. All categories move in historically high price ranges.

The work does not loosen

Yes OK the slaughter fell last week due to the March 8 strike, it remained above 50,000 heads, with 51,784 cattle. In the annual accumulated they add up to 521,916 heads, 15% more than in the same period of 2021.

This strong industrial dynamic is one of the main drivers of the rise in prices for cattle. As long as the slaughter remains at these high levels, the firmness of the market will persist, consignees consulted agree.

Availability of well-finished lots remains low. In the slaughter there is also a component of free range cattle.

john samuel

The livestock market remains firm.

US$ 5,007 per ton

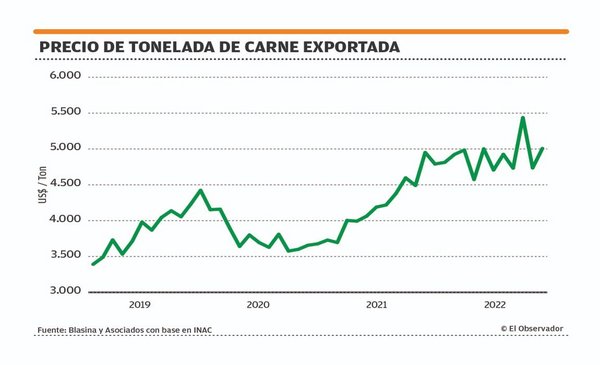

The export price ratifies a scenario of historically high values. This is another of the elements that supports the firmness of the fat man. In the last week the exported ton averaged US$5,007 for beef, according to preliminary data published by the National Meat Institute (INAC), and in the last four mobile weeks, US$4,978. In the annual accumulated, the average value is 4,874, 30% above the US$ 3,752 of 2021.

From abroad there is some sign of loosening in China, a market that is a little “slower” and with an adjustment in values that began days ago and was consolidated this week.

There is caution due to the increase in covid cases and fear that there will be a halt in consumption. Industrial sources consulted understand that a structurally favorable situation does not change.

Europe, meanwhile, remains a strong destination.

EO

What Plaza Rural showed

The effervescence of the price of fat cattle and an optimal forage panorama underpin the replacement market. This week, the values of calves in Plaza Rural set a new record for the consortium, with an average of US$ 2.93 per kilo and US$ 512 per bundle, with maximums of US$ 3.65. Sales were total.

Green arrows in sheep

The sheep market shows green arrows in all categories. Heavy lamb is priced at US$4.42 per kilo, sheep at US$4.38, capons at US$4.02 and sheep at US$3.91. The demand is sustained and there is good placement.

Last week 18,838 sheep were slaughtered, almost half that in the same week last year and the annual accumulated was matched. 270,551 animals have been slaughtered so far in 2022, just 0.2% more than in 2021, with a greater participation of sheep than lambs, the reverse of a year ago.

in sheep meat, the export price crossed US$ 5,000 per ton again after four consecutive weeks below that reference, with US$ 5,069. So far this year, it has averaged US$5,097, an increase of 7% compared to US$4,750 a year ago, with a decrease in the volume exported, pressured by lower purchases from China.