The man chained himself in one of the headquarters of the financial institution for the scam of which he was a victim.

News Colombia.

The case that kept Villavicencio in suspense for two days took a decisive turn this Thursday, when Bancolombia returned the $600 million that had disappeared from Giovanni Cerón’s business account. The businessman, desperate for the lack of answers, had chained himself inside a bank office with his wife and daughter to demand an immediate solution.

The protest, which quickly went viral on social networks, exposed the tension between the financial institution and the client. In the images, the family was seen with chains on their torsos and posters denouncing the loss of the money, which – according to them – was transferred in three movements to a Nequi account without any type of additional validation. For Cerón, this absence of controls revealed a serious flaw in banking security.

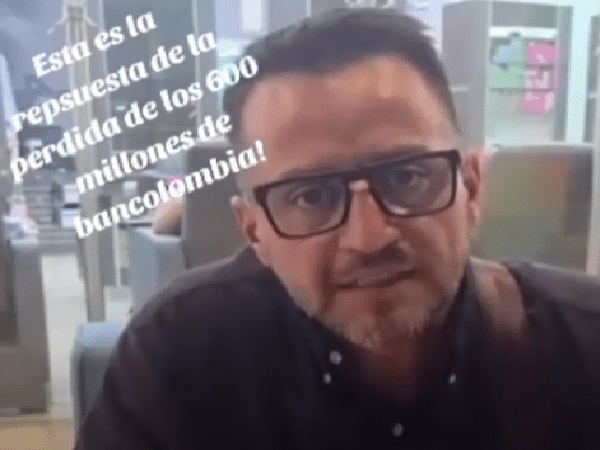

The irregular withdrawal occurred on February 17, but only after the businessman made the demonstration public did it begin to receive priority attention. “If I don’t stop, they don’t pay me,” he said as he left the headquarters, visibly upset. He assured that the entity initially did not offer any convincing explanation and that only after media pressure did the version appear that classified the event as an alleged cyber theft.

Cerón maintained that his intention was not to create chaos or block the operation of the bank office, but rather to protect the working capital of his company in Puerto Gaitán. “I chained myself because I needed an answer. It is my assets, that of my family and that of my employees,” he said after recovering the funds. The family appreciated the citizen support that helped make the case visible.

After the money was returned, Bancolombia reported that it opened an internal investigation to clarify how the transactions were carried out without the owner’s authorization. The entity assured that it will keep the details confidential until reaching conclusions, although it stated that it will reinforce digital security protocols to avoid similar episodes.

Meanwhile, the case has reignited the debate about financial vulnerability in Colombia and the role of social networks as a pressure tool. What happened with Giovanni Cerón not only tested the banking response to digital fraud, but also the power of public outrage to accelerate solutions that otherwise could take days or weeks to resolve.

You may be interested in: