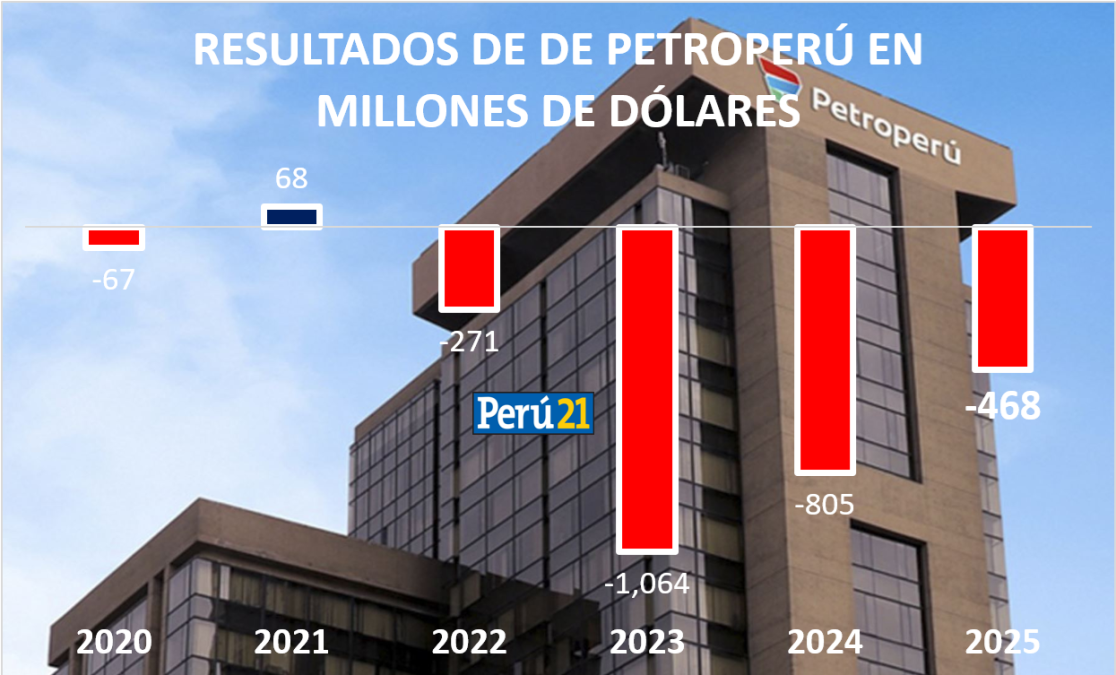

Petroperú reported losses of US$468.3 million at the end of 2025, which accumulated four consecutive years with results in the red.

According to the financial statements published in the Superintendency of the Securities Market (SMV), the company continues without generating sufficient income to cover its operation, registering a drop in turnover of 2.5% compared to 2024.

The US$3,439 million reported as sales during 2025 were insufficient to cover production, distribution and administrative expenses, which together amounted to US$3,637 million, without even considering the financial obligations of the state company.

Asset deterioration

According to the information reported, the level of debt has worsened: the company’s liabilities went from representing three times its equity in 2024 to four times its equity in 2025. This critical situation is directly associated with the reduction of the company’s capital.

Due to the accumulated negative results, the oil company’s equity fell 19.3%. The accumulated losses went from representing 43.6% in 2024 to 54.5% in 2025. Given this scenario, Proinversión spokespersons recently indicated that the state oil company is virtually bankrupt.

What did the company say about the losses?

Petroperú explained that among the favorable factors that explained its results, the following stood out:

- The operational restrictions derived from port closures due to abnormal waves, which had an impact on the operation of the NRT and did not allow the normal supply of crude oil to the refinery and the normal supply of its production to terminals and plants, in the first half of the year.

- The downward trend in international prices of crude oil and products impacting the realization of inventories.

- The commercialization of Crude Oil in the months of January and February, due to operational restrictions in the NRT crude oil reception system, derived from the environmental event at the Submarine Terminal and port closures due to anomalous waves.

- The continuation of restrictions on bank credit lines that affected the availability of liquidity for the acquisition and assurance of supply of crude oil and product for processing in refineries.

- Lower contribution of oil lots to the net result (29 vs 77 MMUS$), due in part to the culmination of the license contracts for lots I and VI in the month of October 2025, as well as the negative results of Lot Z-69.

- Fixed expenses of the Pipeline, without the respective generation of income for crude oil transportation service.

RECOMMENDED VIDEO