The institution is already one of the five largest by number of clients and the third in credit cards issued.

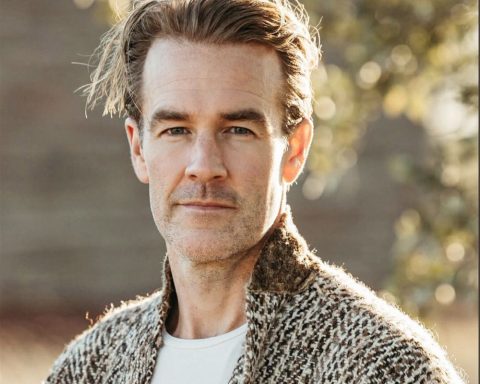

“Our commitment to Mexico is long-term. By 2030, we expect to have invested $4.2 billion in the country, including an estimated $2.4 billion in strategic spending over the next four years, in addition to the capital we already have in the country,” said Nu CEO Armando Herrera.

The institution highlighted that the almost 14 million clients it has are the equivalent of 14% of Mexico’s adult population and is Nu’s second most important market.

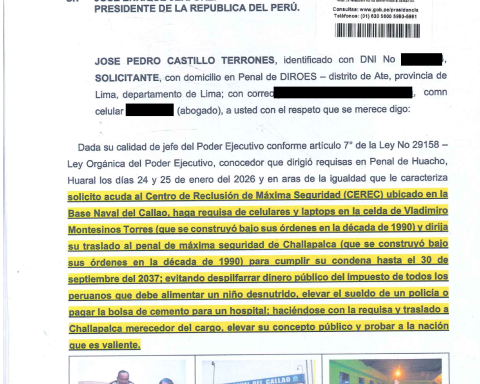

The firm is in the final phase of preparation for the CNBV audit, with the start of full banking operations scheduled for 2026. Once they receive this latest authorization, Nu will be able to expand its range of products such as payroll portability in addition to increasing deposit limits.

Nu operates in Brazil, Mexico and Colombia; recently announced that it received the first authorization of its banking license in the United States.

Armando Herrera highlighted that the business in Mexico is growing at faster rates than it did in Brazil, where they originate.

“Engagement is happening faster, and so are business results,” said Herrera, who said that 78% of Nu’s clients live outside big cities or in regions where traditional banking does not have a presence.

“About 22% of our customers were cash-only transactions before Nu,” Herrera said.