Marco Belmonte / Page Seven Digital

The United States Federal Reserve (Fed) raised its reference interest rates by a quarter of a percentage point to 0.25-0.50%, in its first increase since 2018, to face inflation at a maximum in 40 years . In Bolivia, an expert warns of impacts on the economy.

The conflict situation in Ukraine “could create additional upward pressure on inflation and weigh on economic activity,” the Fed warned in a statement, after a two-day meeting of its monetary policy committee (FOMC), AFP reported.

Those responsible for the agency foresee additional rate hikes this year, and predict a GDP expansion of 2.8% in 2022 compared to 4% of their previous forecasts.

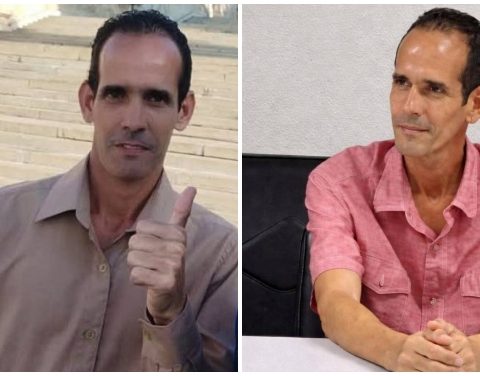

The economist Germán Molina warned that Bolivia will feel the impact of the rise in interest rates in the United States with an increase in the cost of external financing to be contracted from that date.

“It will be more expensive in the future, for example, to obtain financing through the issuance of sovereign bonds than it was until now,” he specified.

You can also read: Industry warns of higher costs due to rising aluminum

The other effect for Bolivia and Latin America would be an outflow of capital. “Foreign investors are going to choose to take their capital to the United States, attracted by the interest rate, because it is a country that now offers them a better return for their dollars, guarantees legal security, economic freedom and free movement of capital” Molina pointed out.

The Fed reported a “high inflation” that is explained by “supply and demand imbalances related to the pandemic, high energy prices and generalized pressures on prices”, for which further increases in the monetary policy rate will be “appropriate”.

The Fed cut its benchmark interest rate to zero in March 2020 to support the economy, consumption and investment, in the face of the coronavirus pandemic.

The decision to raise rates by a quarter of a percentage point was almost unanimous: only St. Louis Fed President James Bullard voted against it, favoring a half percentage point hike.

The head of the Fed, Jerome Powell, said that the body will seek to control inflation, without affecting economic growth.

Powell said at a press conference after the FOMC meeting that it will take “longer” than expected to bring inflation to the 2% target, but said growth remains strong and he sees no risk of a recession, according to AFP.

“Inflation will probably take longer than expected to return to our price stability target,” he said.

The agency’s projection is 4.3% inflation for 2022 and 2.7% next year, before reaching 2.3% in 2024. This is “a clearly higher trajectory than expected in December”, Powell stated.

You can also read: Credits from the BCB to the TGN rise 38.8% in one year and total Bs 47,803 million

Inflation marked 7.9% at 12 months in the United States last February, according to the CPI index of the Department of Commerce. The Fed prefers to be governed by the PCE index which accounts for +6.1% at 12 months in January.

These are numbers that resurface the specter of double-digit inflation from the 1970s and early 1980s, when the Fed pushed rates to 20%, containing inflation but at the cost of a recession.

The market expects a total of seven rate hikes this year, to bring this reference to 1.75% per year.

Raising guideline rates leads commercial banks to propose higher rates to their clients to take out loans to purchase homes, cars, household appliances, or investments for companies.

This measure hits consumption and relieves pressure on prices, in a context of problems in supply chains, and a sharp rise in fuel and food prices due to the war in Ukraine.

The Fed will now have to address the reduction of its balance sheet, that is, to separate little by little from the billions of dollars in Treasury bonds and other assets that it has held since March 2020 to sustain economic activity in the midst of the pandemic.

“The Committee expects to start reducing its assets (…) at a future meeting,” the Fed said without further details.

Stock market reaction

The New York stock market ended strongly rising, quickly incorporating the rate hike decided by the US Federal Reserve, and driven by a drop in oil prices and expectations of advances between Russia and Ukraine.

Thus, the Dow Jones gained 1.55% to 34,063.10 points, the technological Nasdaq 3.77% to 13,436.55, and the S&P 500 2.24% to 4,357.86 units.

“The announcement was as expected,” said Bill Northey of US Bank Wealth Management. “There was no surprise, but the Fed took a somewhat more aggressive stance on monetary policy,” he said.