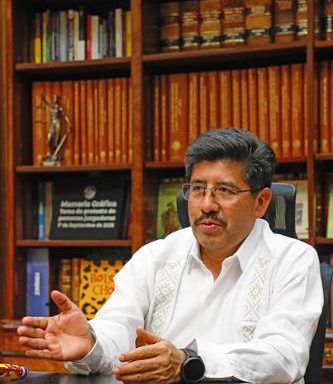

Valenzuela said that one of the lines of action for 2026 is to help companies relocate via the financing of industrial warehouses that will help Foreign Direct Investment.

Of the almost 259,000 million that this second-tier bank placed last year, 44,220 million were used to finance industrial warehouses, while 77,430 million were for energy projects.

Companies in the automotive sector received 10,570 million pesos in financing from this bank.

Last week, President Claudia Sheinbaum met with different representatives of the financial sector: Treasury, Banxico and directors of some banks in the country.

It was later learned that specific plans regarding infrastructure and energy were announced at that meeting. The government and private banks are working on a project in which, with the help of development banks, SMEs access loans with guarantees in commercial banks.

Regarding this, Bancomext said that they already work with more than 10 commercial banks, without specifying the names.

Valenzuela explained that the guarantees that are being offered in favor of these SMEs range between 60 and 70% so that the commercial banks make the loan under good conditions.

The main complaint of these companies is that commercial banks traditionally provide more expensive financing or with requirements that are almost impossible to obtain, such as collateral. The commercial banking argument for doing it this way is that when a company defaults on its payments, recovering that guarantee takes a long time.

Bancomext is also extending this benefit of guaranteed loans to Sofomes and Sofipos.