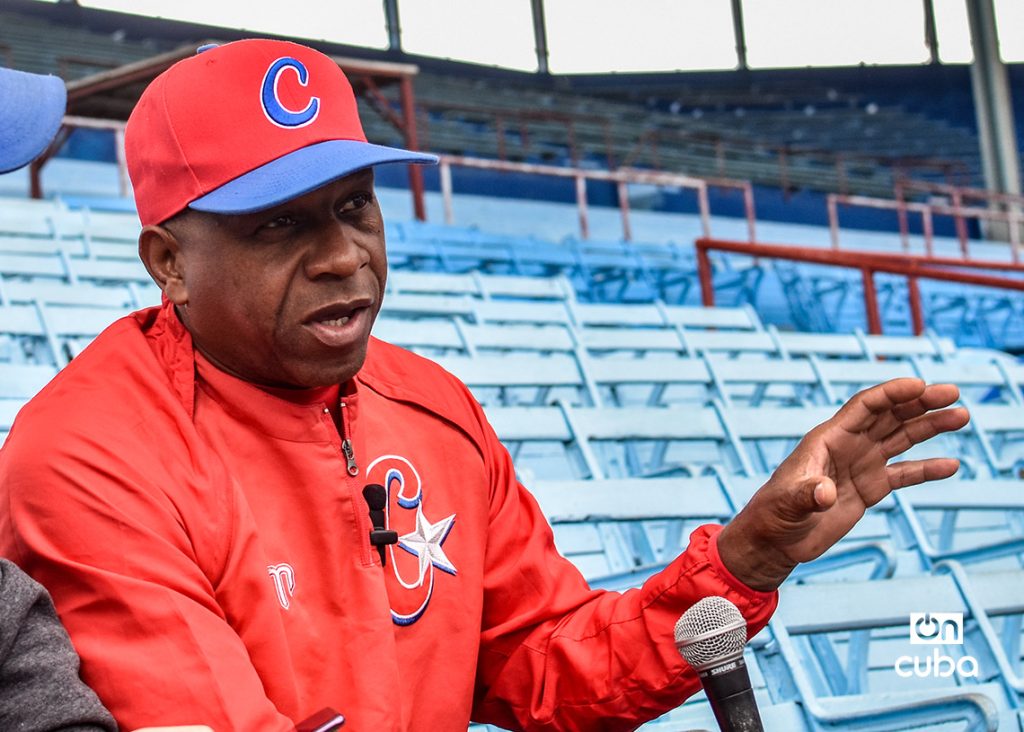

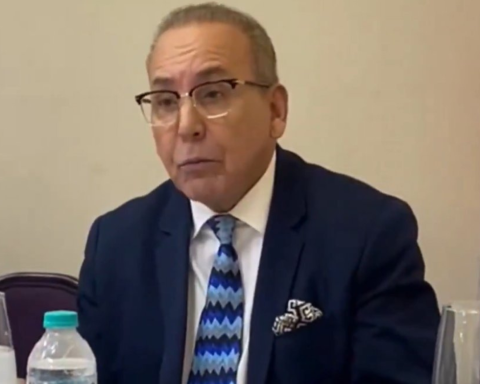

A new public bond will be launched in March by the National Treasury. Called Treasury Reserve, the new title will be indexed to the Selic basic interest rate and aims to attract more investors to Tesouro Direto, said this Friday (30) the secretary of the National Treasury, Rogério Ceron.

“Treasury Reserve will come together with the new Tesouro Direto platform, which will run 24×7, that is, it will be available 24 hours a day, seven days a week, precisely to provide access mainly to the most popular sections of the population who, during the day, do not have the time or conditions to have access to it”, he explained.

During an event held this Friday afternoon at B3, in the capital of São Paulo, Ceron revealed that the Treasury Reserve investor will be able to make investments from R$1. The maturity of the paper will be 3 years, but redemption can be made at any time, without discounts.

“To start well, precisely for this public that wants profitability, but also wants security, as they do not want to put their saved money at risk, we are launching the Treasury Reserve. It is a floating rate, but without market marking. There will be no risk of a fluctuation in price. The investor will be able to redeem whenever he wants, 24 hours a day, seven days a week. He will be able to buy or sell [o título] and there will be no price fluctuation. He will also be able to apply from R$1. They are R$10 bonds, but from R$1 he can make an application”, he explained.

The title is already in operation for a restricted group of Banco do Brasil customers, in the testing phase, but from March, said the secretary, it will be open to investors in general.

Currently, Tesouro Direto has just over 3 million active investors. With the new title, the intention is to increase this number of investors and also be able to offer a new type of investment – simpler and safer.

“Today, unfortunately, many Brazilians are induced to make an application, without making a conscious choice. Giving citizens the option to make their choice is an act of citizenship,” said Ceron.

The secretary drew attention to the current situation in asset applications. “We are seeing what is happening at the moment with problems with investments in assets that are risky and, often, people didn’t even know about it. It is very important that people make conscious choices and make their decisions. Those who want security with profitability or those who want to take more risks, do so consciously”, he said.