Although it serves to secure assets and save for emergencies, this type of financial product is little known in Ecuador.

Anyone should ask themselves how am I going to protect my family or estate What do I leave to my relatives, if I die prematurely? In this event, it is best to make sure with a life insurance.

One of the great lessons of the pandemic is the importance of protecting the patrimonial impacts caused by the effects on health and lifetime of our loved ones.

Although the pandemic caused a lot of damage in general terms, on a global scale it also taught some things of great value such as the importance of protecting the life and heritage.

It became clear that financial planning and the acceptance of the existence of risks can be the lifesaver that allows facing unexpected moments, without affecting the quality of lifetime and the tranquility of the people and the families.

Hence the importance of investing in a life insuranceas this is a financial instrument that helps reduce economic uncertainty about the future.

It is a fundamental ally, since through a insurance policy (in the short, medium and long term), it is possible to mitigate the impacts on the heritage of people and their families can bring situations like death or the total and permanent incapacity that is rarely contemplated.

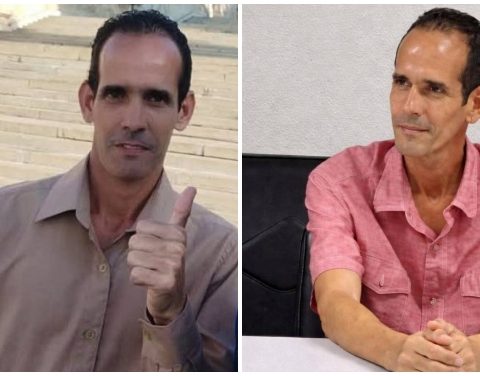

“This type of product allows people to recover from an event that directly affects their economy; additionally, in the event of death, the beneficiaries have sufficient funds for funeral expenses, it allows the children to continue their studies, and it guarantees the well-being and quality of life of the beneficiaries with all the economic implications that this means,” he explained. Carlos Vera, expert in insurance.

Despite the advantages, less than 8% of Ecuadorians and 2.5% of Ecuadorians have life insurance, according to a latest study by the Development Bank of Latin America (CAF).

What should be taken into account to take out life insurance?

1.- It is necessary to clarify that there are no fixed prices for life insurances since, each one is defined by the person who is interested in acquiring it. The value or the premium to be paid each month arises through a consultancy where the needs are analyzed and variables such as lifestyle, the objective and type of insurance, the age of the interested party, among others, are determined.

2.- The earlier the age of acquisition of the life insurance, the monthly premiums will be cheaper compared to advanced ages (comparing the same qualities of insurance). In other words, the recommended age is between 28 and 40 years, because in that period it is the most productive and healthy phase of a person. Thus, better conditions can be negotiated; In addition, you can accumulate a greater heritage that can be used by the family or beneficiaries in case of death or serious illness.

3.- The types of insurance may vary as it may benefit the family, partner, children or other important people; In the event that the insured dies or, on the contrary, if death coverage is not contracted, protection can be counted on in the event of accidents or serious illnesses.

4.- The insurance are intended to protect and provide financial stability to people and family in the event of the death of the insured. This is especially important for men and women heads of households or with several people under their responsibility. In addition, the money paid monthly in premiums, and invested to generate returns, can be used when unforeseen events and expenses occur.

5.- To hire a life insurance, people can apply through their insurance agent or by contacting the insurer directly. Payments can be negotiated to be annual, semi-annual, quarterly or monthly. On average, those payments can range from $30 to more than $200 a month. (JS)