“Miami-Dade will not be used as a platform to finance or sustain” the Havana regime, said the county tax collector.

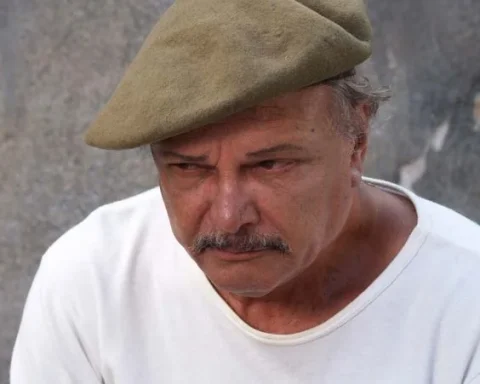

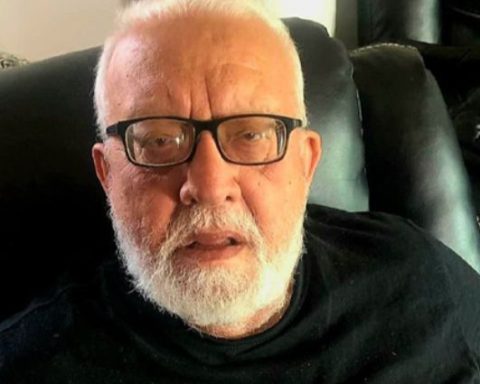

MIAMI, United States. – Miami-Dade County Tax Collector, the Cuban-American Dariel Fernandezannounced that his office revoked, “with immediate effect,” the Local Business Tax for 20 companies that could not demonstrate a valid federal authorization to carry out transactions linked to Cuba.

In a post on FacebookFernández stated: “Today I took decisive action to revoke Local Business Tax licenses from companies that illegally participate in trade with the Cuban communist dictatorship.” He also assured that “Miami-Dade County will not be used as a platform to finance or support a regime that represses its people and violates federal law.”

In an official document dated in Miami-Dade this Monday, December 22, Fernández maintained that the measure is protected by “Section 205.0532” of the Florida Statutes and in “Section 8A-175.1” of the Miami-Dade Code. The state rule establishes that a local authority “may” revoke or refuse to renew the local tax receipt if the business – or its parent company – “is doing business with Cuba.” Instead, the county code indicates that the collector “must” revoke or refuse to renew the Local Business Tax when the individual or entity “is doing business with Cuba in violation of federal law.”

According to the collector’s statement, his office opened a formal compliance process that began last October 28, when he sent a first round of 75 letters to companies “suspected” of participating in trade with Cuba. In those notifications, it requested documentation proving authorization under federal law, including “a specific or general license” issued by the Office of Foreign Assets Control (OFAC) of the United States Department of the Treasury or by the Bureau of Industry and Security (BIS) of the Department of Commerce.

According to the text, 48 companies responded and provided sufficient documentation or demonstrated that they did not do business with Cuba; On November 25, the remaining companies received a second notice by certified mail, with the warning that the lack of response would be considered an indication of the absence of federal authorization and, therefore, exposure to revocation.

After that period, Fernández’s office proceeded to revoke the Local Business Tax from the following entities:

Havana Sky Travel Inc. (two locations)

AMZ Immigration and Multi-Services Corp.

Global Cargo Corp.

Globi Multiservices Inc. (d/b/a Globi Envios)

Managua Travel Agency Inc. (d/b/a Cuba Travel & Services)

BM Envios Cargo Corp.

R & R Logistics Customer Freight Solutions LLC

Leafy Holidays Inc.

JM Services LLC

Yumury Envios & Travel LLC (two locations)

Lucero Services Corp.

OMD Multiservices LLC (d/b/a Martinair Travel)

JC Montoya Services Inc.

Latin Logistics LLC (d/b/a Avianca Express)

Capote Express Inc.

Pocho Express LLC

Xcellence Travel Inc.

Via Blanca Multiservice Inc.

Your Cuba Multiservices Corp.

Xael Charters Inc. (two locations)

Fernández highlighted in the document that “the repeal of the Local Business Tax is a significant measure” and added: “Effective immediately, these companies cannot legally operate in Miami-Dade County.” It further warned that any business that continues to operate without a valid Local Business Tax would be “subject to additional enforcement actions, including penalties and legal consequences under applicable law.”

In the same text, he recalled that the Havana regime “has been, is and will continue to be a threat to the national security of the United States,” so “Miami-Dade County will not be used as a platform to finance or sustain it.”

The official anticipated that there will be new actions. “In the coming weeks, more companies will be notified, and those that do not comply with the requirements will have their Local Business Tax revoked. This is just the beginning,” he indicated in the document, before closing with the phrase: “The time to act is now.”

He Local Business Tax It is the tax receipt or license that, in Miami-Dade, is required to operate legally and is administered by the collector’s office. In practice, the revocation of that document prevents the business from operating legally within the county, although the determination and criminal prosecution of violations of the federal sanctions regime corresponds to federal authorities, as local media have explained in previous reports on this type of measures.