The Central Bank of Cuba (BCC) opened a legal and banking channel so that non-state forms of management can acquire foreign currency in the new exchange marketan unprecedented possibility until now within the official financial system.

The measure will allow these economic actors to buy foreign currency through applications in commercial banks and through their fiscal accounts, without the use of cash, explained Ian Pedro Carbonell, director of Macroeconomic Policies of the BCC, quoted by the Havana Citizen Portal.

In accordance with the regulations, Purchases will be limited to a maximum of 50% of the average gross income recorded in the tax account during the last quarter.

The design, according to the statement, avoids fixed limits and links access to foreign currency with the real level of activity of each business, while reinforcing the objectives of banking and circulation control.

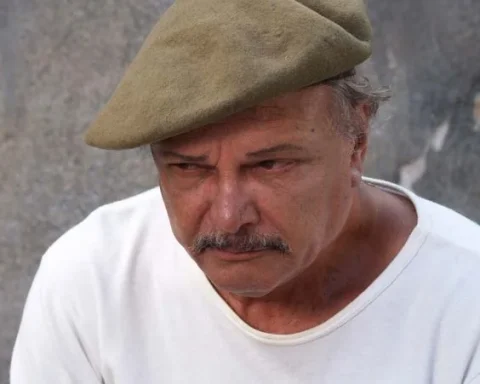

“We do not consider it appropriate to establish a fixed amount, because each actor has different levels of activity”explained to Cubadebate the director of Macroeconomic Policies of the Central Bank of Cuba, Ian Pedro Carbonell.

No changes for natural persons

For natural persons, no changes are introduced, since the limit of up to 100 US dollars per transactionunder the same current procedure. The sale will continue to be carried out in 41 authorized offices and through the shift system managed by the Ticket application, says the BCC.

Carbonell acknowledged that Ticket waiting lists remain because demand exceeds the availability of foreign currency. However, he indicated that the introduction of a new exchange rate could modify behavior on the part of buyers and eventually reduce pressure on the system.

Likewise, he added that the offices that join the scheme will begin with new shifts, although they will operate under the same mechanism.

The manager indicated that the use of the ticket system will be retained temporarily “until the previous operation is recovered, in which it was bought and sold naturally.”

Last Thursday, Cuba launched a new exchange rate floating that will coexist with the other two rates that remain officially in force.

The measure seeks to “incentivize the entry of foreign currency into the exchange market, which will constitute a source for its operations and will reduce the pressures and irregularities of the informal market,” explained Delgado during a recent television intervention.

Asked about the value of the new rate, the director of Macroeconomic Policies of the BCC acknowledged that it is not low. “Maybe it is not what many expected, but it is what will allow the exchange market to work,” he said.

For Carbonell, the new rate “is based on real operations” and not “on purchase and sale intentions, as occurs in the informal market.”

In his opinion, the new measure could not be postponed, because “continuing waiting was the worst scenario.”

“Natural persons need to exchange their remittances for national currency. Economic actors, both state and non-state, need access to foreign currency to complete their production cycles and, in the case of exporters, also change these currencies into national currency,” he explained.

The establishment of the new floating rate had been announced for the second half of the year by Prime Minister Manuel Marrero. However, as the months progressed and the worsening of the economic crisis in the country, it was suggested that the measure would be postponed again.

The new rate came in the midst of a government crackdown against the informal currency market and informal remittance mechanisms, in parallel with the authorities’ accusations against the opposition. The Touch and its exchange rate, used mostly by Cubans as a reference for the purchase and sale of currency.