In recent decades, many countries have incorporated the tax competition as part of their strategies to attract investment and boost its economy. The experience of the ancient soviet bloc It is especially useful: after the fall of the planning system, these economies promoted profound reforms aimed at rebuilding market institutions and creating more favorable conditions for production, entrepreneurship and innovation.

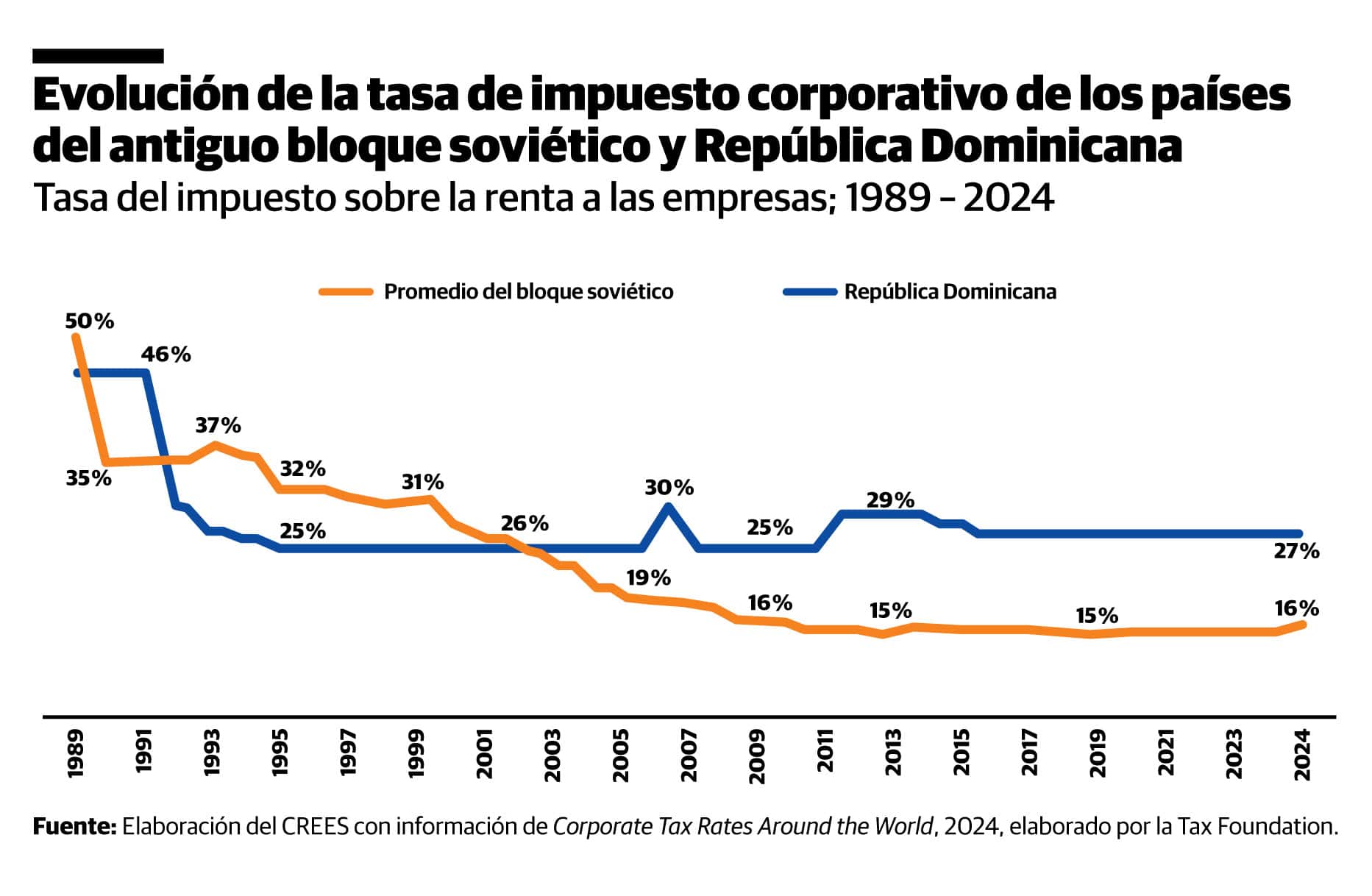

A key aspect of that transition was the sustained reduction of the rate of income tax to companies. In the early 1990s, the region applied rates close to 50%. However, as the opening process progressed, these economies adopted more competitive schemes. By the mid-2000s, the average was already below 25%, and today it is around 16%. Countries that started from weakened institutions—such as Georgia, Estonia, Hungary or Bulgaria—managed to consolidate tax frameworks aimed at investment and capital formation.

Dominican Republic initially followed a similar trajectory, reducing its corporate rate during the nineties. However, that trend stopped, while other countries continued to adapt to a dynamic global environment. Currently, the corporate rate Dominican Republic is 27%, above that applied by nearly two-thirds of the jurisdictions in the world.

International evidence suggests that countries that strengthen their economic institutions, simplify their regulatory framework and promote competitive tax schemes They tend to expand their productive capacity. For Dominican Republicresuming this agenda is an opportunity to attract more investmentencourage innovation and generate a favorable environment for entrepreneurship and long-term growth.

__________

A collaboration of the Regional Center for Sustainable Economic Strategies (Do you believe).