Asofondos and Fasecolda warn that a MinHacienda decree could defund pensions, increase costs and reduce protection for millions.

Asofondos and Fasecolda They issued a warning about the risks that a draft decree published by the Ministry of Finance would have for the pension system, which could defund pensions of millions of Colombians and significantly reduce protection for the most vulnerable population.

According to the unions, the Government’s proposal would generate three main effects such as a decrease in the number of people who would be able to retire, lower pensions, and weakening of the pension insurance that protects against the risks of disability and survival.

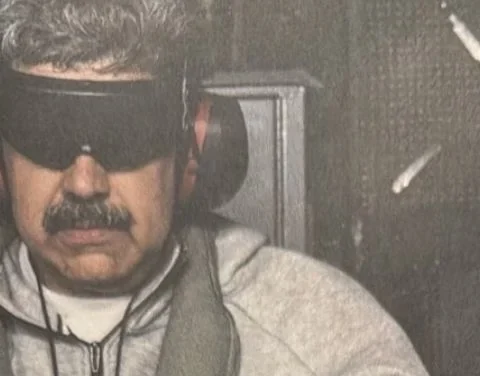

More news:Front leader Carlos Patiño is captured in Popayán in a key blow against dissidents

The central point of concern is the modification of the “minimum wage sliding” rules, a mechanism that annually adjusts minimum pensions in line with the increase in the minimum wage. “Currently, this adjustment is based on three factors: inflation, productivity and a discretionary component of the Government. The first two are covered by workers’ savings; the third, because it is unpredictable, is financed by the State,” said Andrés Velasco, president of Asofondos.

They stated that this proposed decree would transfer part of that discretionary component to the individual savings of future pensioners.

This, according to the unions, would mean that those who aspire to an annuity would have to contribute up to 30% more to access a minimum pension, which would make retirement difficult and reduce benefit amounts.

They warned that the change would also have consequences for the pension insurance that finances disability and survivor pensions.

Asofondos and Fasecolda pointed out that the mechanism would no longer be viable due to the increase in costs, which would put at risk the protection of about 20 million members to the Individual Savings Regime (RAIS).

“If there is no one who offers this insurance due to the high increase in costs, millions of members will be left unprotected in moments of greatest vulnerability,” said Andrés Velasco, president of Asofondos.

He pointed out that currently, thousands of Colombians who do not complete the required weeks manage to retire thanks to having accumulated sufficient capital.

“However, the project would raise the minimum amount of capital required, which would leave many workers without the possibility of access,” he highlighted.

He stated that for old-age pensioners, the impact would be a greater saving effort to obtain a minimum income.

“For cases of disability and survival, the protection of pension insurance would be at risk of disappearing,” he said.

For this reason, the unions describe the initiative as regressive, since it would reduce the level of protection guaranteed today.

Request to the Ministry of Finance

He indicated that the potential unviability of pension insurance would imply that the State would have to assume disability pensions, as well as survivor pensions in cases of death before retirement age.

“This would generate an additional tax obligation close to 2 billion pesos on average during the first 10 years. These resources could strengthen solidarity programs such as Colombia Mayor, or other needs,” said Velasco, who stressed that the initial fiscal relief would be temporary and will bring greater burdens in the medium term.

Also read:In China, pets star in Zootopia 2

Asofondos and Fasecolda requested the Ministry of Finance to install technical tables that would allow them to discuss the effects of the draft decree and avoid negative impacts on workers, pensioners and the sustainability of the system.

“It is essential to evaluate any modification from a comprehensive and systemic perspective,” said Gustavo Morales, president of Fasecolda, who called for harmonizing the rules to avoid fragmented or contradictory regulations.

Source: Integrated Information System