Petrobras’ Financial Director, Fernando Melgarejo, clarified this Friday (28) that Petrobras will be able to maintain the debt target at US$65 billionforeseen in the 2026/2030 Business Plan, even with the lower value of Brent oil on the international market.

According to Melgarejo, the estimate is that the company’s debt will reach US$70 billion this year and fall to US$65 billion in 2026.

With a barrel of Brent projected at US$63, the company will be able to reduce part of its debt next year. If the price varies between US$59 or US$60 per barrel, “we will have a neutral net debt, that is, it will not grow”.

He made it clear that Petrobras is working to achieve maximum efficiency and cost optimization to reach US$67 billion next year and reach US$65 billion from 2026 and during the 2026/2030 Business Plan.

Extraordinary dividends

To distribute extraordinary dividends, Melgarejo explained that it is necessary to have a robust operational cash flow and leave doubt neutral, so “there will most likely be no extraordinary dividends in the coming periods”.

Of the investment projected in the company’s 2026/2030 Business Plan, of US$ 109 billion, US$ 91 billion will be invested in projects being implemented, considered more mature, and US$ 18 billion in projects under evaluation.

Every three months, Petrobras will check whether the projects under evaluation have financial viability and flexibility to continue.

Peak production

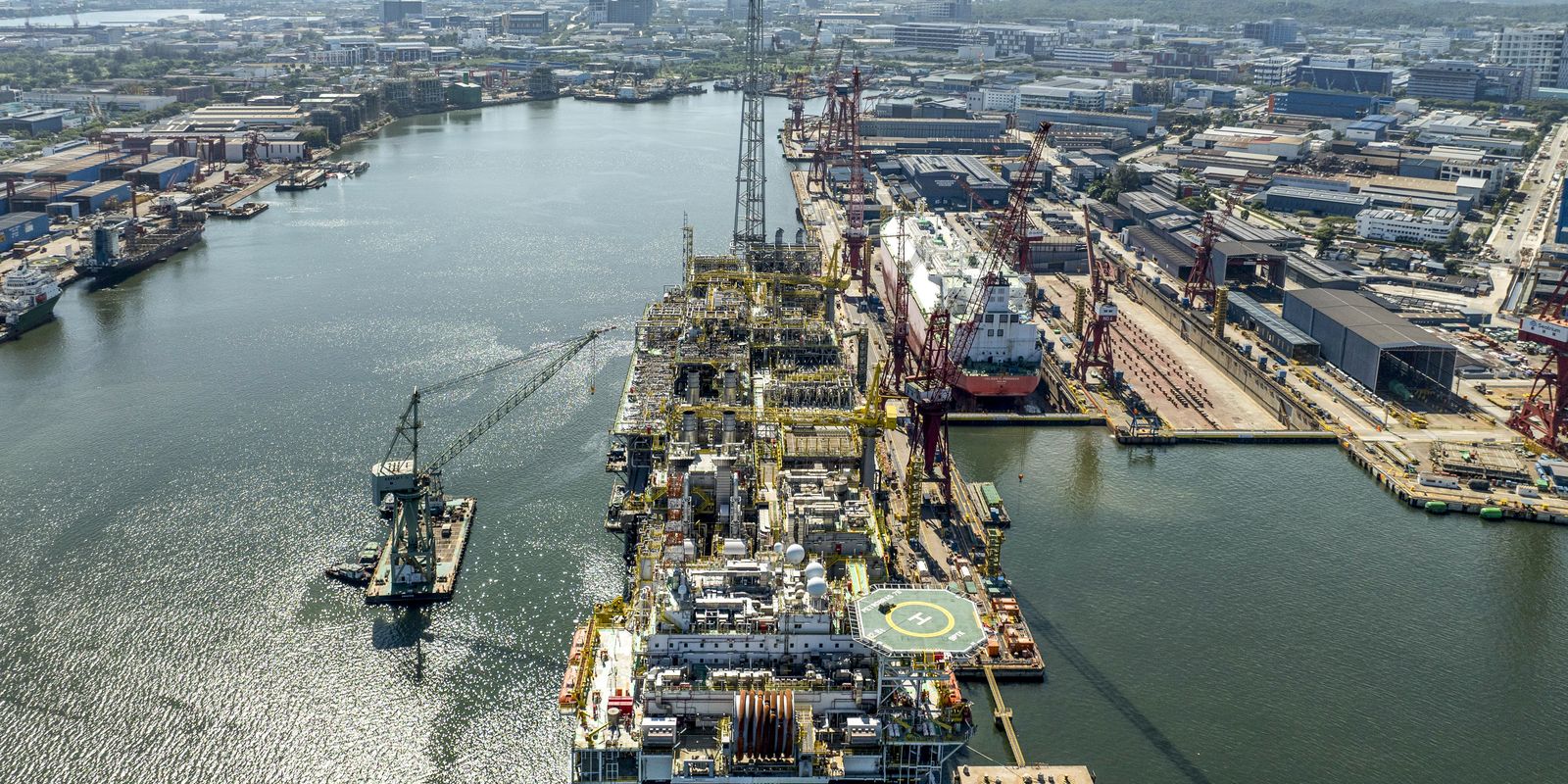

The president of Petrobras, Magda Chambriard, stated that the company expects to achieve, in the 2026/2030 five-year period, production of 2.7 million barrels of oil per day (bpd) in 2028 and 3.4 million barrels of oil and gas equivalent per day (boed) in 2028 and 2029.

“This means new wells hanging on the same platforms, replacing wells that have lost their productivity. This means exchanging less productive wells for more productive ones,” he said.

The increase in production will result from the implementation of eight new production systems by 2030, of which seven are already contracted, with emphasis on the Santos Basin pre-salt, considered “a very precious asset” according to the company’s president.