Prex (Econstar SA) and Paigo (Floder SA) agreed this Monday the incorporation of bank Itau Unibanco as a shareholder with a participation of 30% of the share capital in each company.

“This is a strategic and long-term investment defined by Banco Itaú as part of its vision of expansion and digital banking. Itaú is the bank that grew the most in 2021 in the financial system, both in total deposits, loan portfolio and means of payment,” the bank said in a statement.

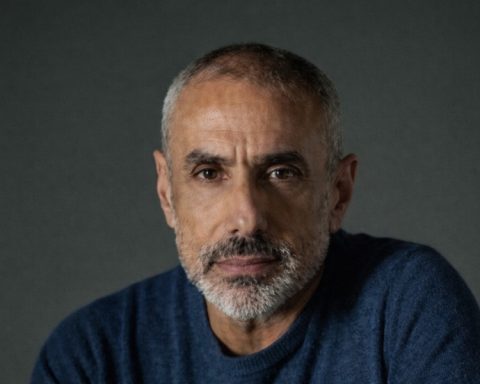

“We are going to contribute with our structure and capabilities to the growth of Prex and Paigo, two companies that emerge from the innovative ecosystem of Uruguay and that have been performing exceptionally well,” said André Gailey, CEO of Itaú for Argentina, Paraguay and Uruguay.

“We are excited to work together with two leading fintechs to offer more people new opportunities to participate in the financial circuit. At Itaú we are committed to leading the digital transformation of banking and this acquisition will consolidate our innovation ecosystem with our sights set on the region”, he added.

In recent years, Prex has established itself as one of the fintech fastest growing in Uruguay and the region. Through the digital account and its APP, Prex provides financial services to more than 1 million customers distributed in Uruguay, Argentina and Peru.

With Prex, people can make local and international purchases, transfers, utility payments, apply for personal loans and have frictionless access to investment options and tools that allow them to easily manage their personal finances.

“Incorporating Itaú, the most important financial institution in Latam as a shareholder, will allow us to strengthen and accelerate our plans for growth, development of new products and regional expansion. This investment will allow us to promote our purpose of reaching more people every day with inclusive and quality digital financial products”, said Alfredo Bruce, CEO of Prex.

According to Martín Guerra, co-founder and shareholder of Paigo“adding a great bank like Itaú as a partner, with a deep understanding of current changes and possibilities, gives us the power to grow not only in Uruguay but also to expand throughout Latam, in addition to allowing us to offer better opportunities for our clients and our team.”

Paigo, from its vision of offering more financial freedom to people, has generated an innovative digital-based financial services platform for unbanked publics that has achieved solid and sustained growth since its creation in 2017. Today it manages Uruguayan Credit, Uin Uin (for good payers), Credisol, Pym (loans for SMEs), Return (designed for those who had financial problems) and Prextamo (for Prex clients).

Soon it will launch Payment After, an innovative proposal in terms of payments and credits. The closing of the operation is subject to the approval of the Central Banks of Brazil and Uruguay, which is expected to be completed in the second half of 2022.