Santo Domingo.-The Dominican economy is headed for an acceleration of growth in the coming years, supported by the support of monetary and fiscal policies, an improvement in credit, the recovery of tourism and the rebound in exports, according to the most recent evaluation of the International Monetary Fund (IMF), corresponding to the Article IV Consultation, concluded on November 12.

The report published by the director of the IMF indicates that the Dominican Republic has strong economic fundamentals and room for maneuver to face persistent global uncertainty, positioning itself better than most emerging countries.

The IMF explains that the Dominican economy experienced a slowdown at the end of 2024 and during the first half of 2025, caused by a more adverse international climate, tighter global financial conditions, and increased uncertainty.

However, he points out that recent indicators point to a recovery underway, driven by the gradual relaxation of monetary policy, fiscal support and the dynamism of key sectors such as tourism, exports and private credit.

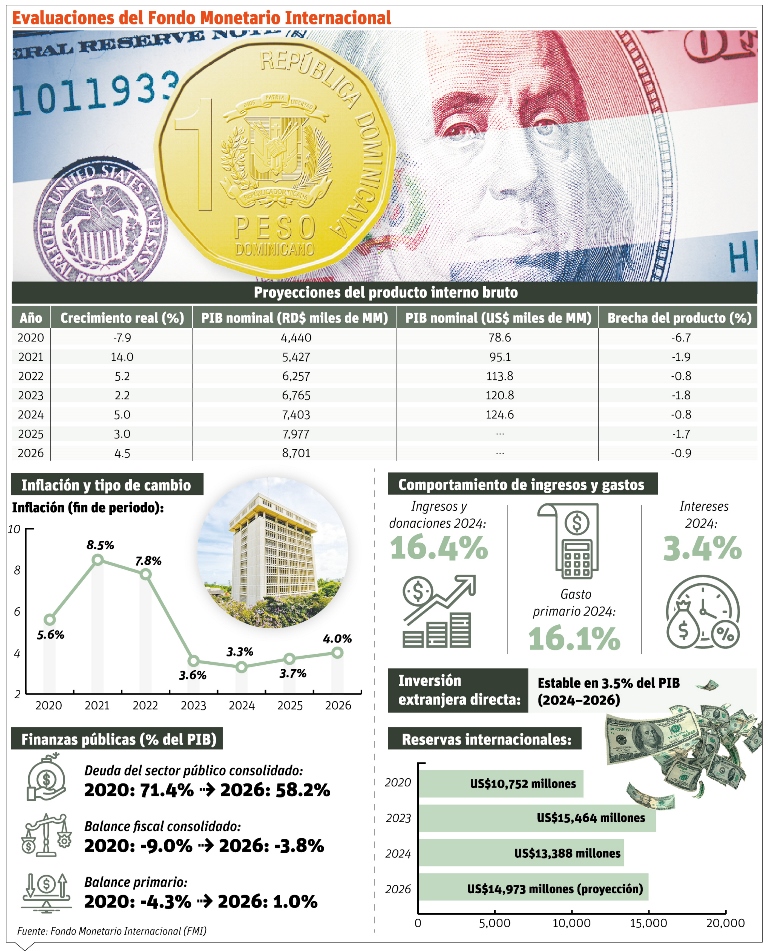

He adds that inflation remains controlled and close to the Central Bank’s goal. The organization estimates that in 2025 it will average 3.7%, within the established range of plus or minus 4%.

Regarding the external sector, the IMF considers that the Dominican position is in line with economic fundamentals, highlighting that the current account deficit will continue to reduce, reaching this year around 2.5% of GDP, a figure largely financed by foreign direct investment. He adds that remittances, exports from free zones and tourism income continue to act as pillars of stability.

Direction to grow 5%

The monetary organization predicts that the Dominican economy will grow 4.5% in 2026, and subsequently return to its potential growth of around 5%, a pace that has characterized the country during the last two decades. He adds that this performance would reinforce the country’s leadership as one of the fastest expanding economies in Latin America.

Deficit reduction

The report indicates that the deficit and public debt will continue on a downward path, thanks to the projected reduction of losses in the electricity sector and a better targeting of subsidies.

He adds that this will free up fiscal space to increase public investment, in line with the Fiscal Responsibility Law.

The international organization praised the country’s institutional advances and recognized the stability achieved, but was emphatic about the need to deepen fiscal and structural reforms, particularly in the electricity sector, considered essential to reduce risks.

Electrical sector

The IMF emphasizes that the comprehensive implementation of the Electricity Pact continues to be “essential” to reduce fiscal pressure and ensure a reliable supply. They also recommended that any future tax reform be based on a medium-term revenue strategy.

Fiscal prudence

Another point highlighted by the organization is the need to maintain prudent fiscal policies, accompanied by efforts to improve the efficiency of public spending and eliminate generalized subsidies, simultaneously guaranteeing the protection of social programs.

The IMF considers the current monetary policy stance appropriate, and encouraged authorities to continue strengthening the monetary transmission mechanism, including measures to further develop the capital market and continue making certain extraordinary liquidity instruments more flexible.

He affirmed that Dominican banks remain strong and that systemic risks are limited.

He applauded regulatory modernization and progress in supervision, but urged progress in the adoption of Basel II and III and macroprudential policy tools.

The IMF also emphasized the importance of continuing to strengthen the framework against money laundering and terrorist financing. Despite its strength, the IMF warns that the balance of risks is biased to the downside with a volatile international financial environment, the persistence of geopolitical conflicts, tightening of global credit conditions and the slowdown of trading partners.

The challenges

—1— Phenomena

The IMF indicates that vulnerabilities to natural disasters and international financial conditions continue to be challenges, although the country maintains room for fiscal and monetary maneuver.

—2— Exports

Tourism, gold and tobacco are the main export items, and the destinations are the USA, Switzerland and Haiti.