The decision of the Monetary Policy Committee (Copom) of the Central Bank (BC) to maintain the Selic rate at 15% per year generated reactions among representatives of industry, commerce, construction and the union movement. For the National Confederation of Industry (CNI), the high level of interest suffocates economic activity and isolates Brazil on the international scene, where most countries have already started reduction cycles.

In a statement, the president of the CNI, Ricardo Alban, stated that the continuation of an “excessively contractionary” monetary policy is harmful to the country.

“Selic has slowed down the economy far beyond what was necessary, since inflation is on a clear downward trajectory. The current rate brings unnecessary costs, threatening the job market and the well-being of the population”, highlighted Alban.

Unpublished research by CNI shows that 80% of industrial companies point to interest as the main obstacle to short-term credit, while 71% consider the rate to be the biggest obstacle to long-term financing.

Civil construction

The construction sector also expressed concern. In a statement, the president of the Brazilian Chamber of the Construction Industry (CBIC), Renato Correia, stated that a high Selic for a long period makes real estate credit more expensive and inhibits new projects.

“Construction is one of the sectors most sensitive to the cost of credit and consumer confidence. A Selic of 15% makes many projects unviable”, he assessed.

In October, CBIC reduced the sector’s growth projection in 2025 from 2.3% to 1.3%, citing the impacts of the prolonged cycle of high interest rates.

Unions point out fiscal impact

Trade unions also criticized the decision. According to the National Confederation of Financial Workers (Contraf-CUT), from the Central Única dos Trabalhadores (CUT), each percentage point increase in the Selic increases public spending on debt interest by around R$50 billion.

“We are talking about almost R$1 trillion diverted to rent-seeking, which could be invested in health, education and infrastructure”, stated Juvandia Moreira, president of Contraf-CUT and vice-president of CUT.

Força Sindical classified the scenario as an “era of extortionate interest rates”. In a note, the president of the central, Miguel Torres, stated that the Central Bank’s policy compromises family consumption and income at the end of the year.

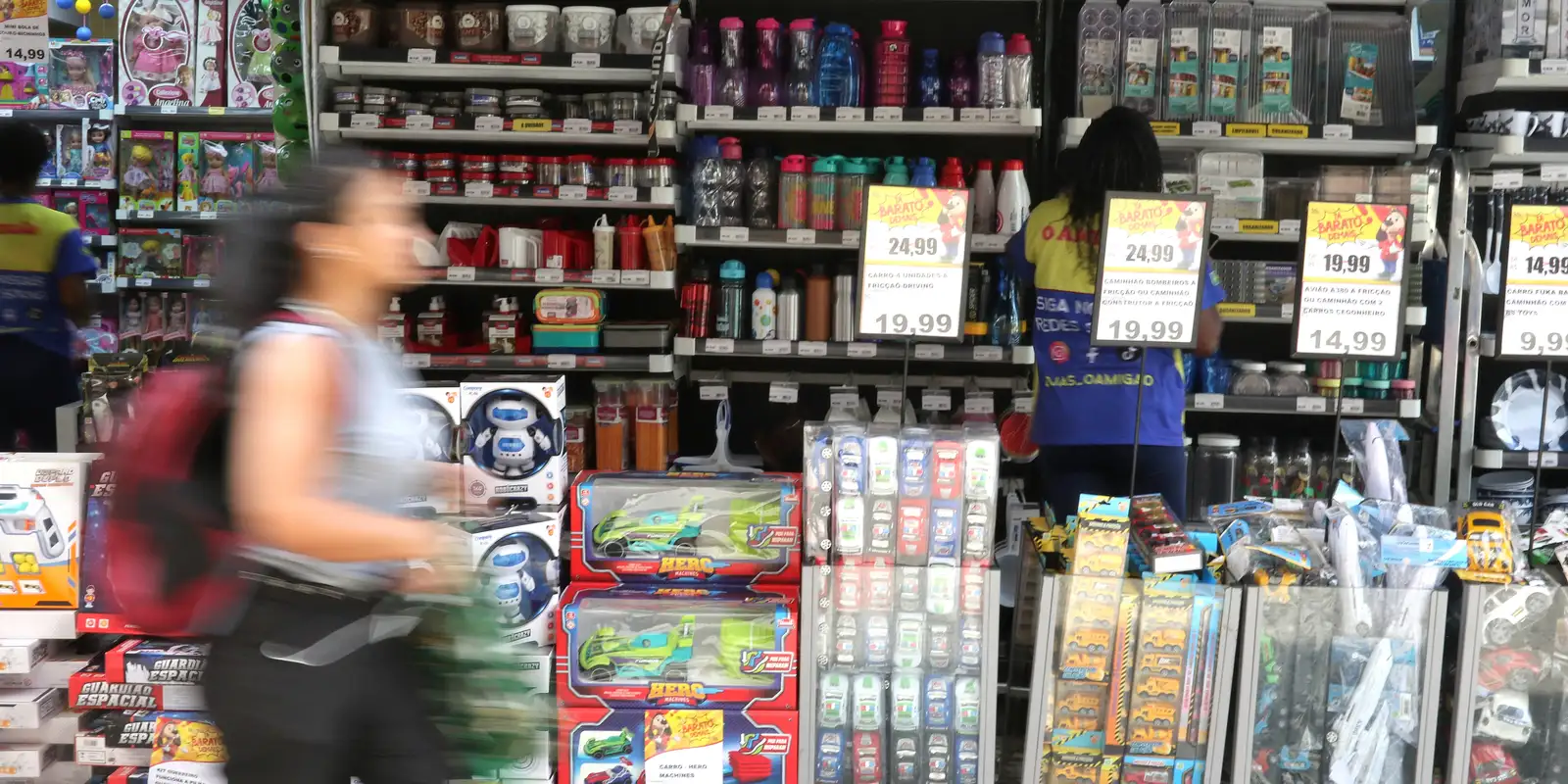

Supermarkets

High interest rates also drew criticism from the supermarket sector. According to the Associação Paulista de Supermercados (APAS), Brazil is going against the rest of the planet, which reduces interest rates.

“Today we have the second highest real interest rate in the world, harming investments, family consumption and perpetuating structural obstacles to development”, highlighted the entity’s chief economist, Felipe Queiroz.

Monetary caution

Although it recognizes that interest rates are high, the São Paulo Commercial Association (ACSP) considers that monetary policy responds to other challenges. According to the entity’s economist, Ulisses Ruiz de Gamboa, the maintenance of the Selic reflects a scenario of inflation still above the target, despite the slowdown in economic activity and the appreciation of the real.

“This situation, combined with fiscal expansion, the resilience of the job market and external uncertainties, justifies a cautious monetary stance”, he explained.