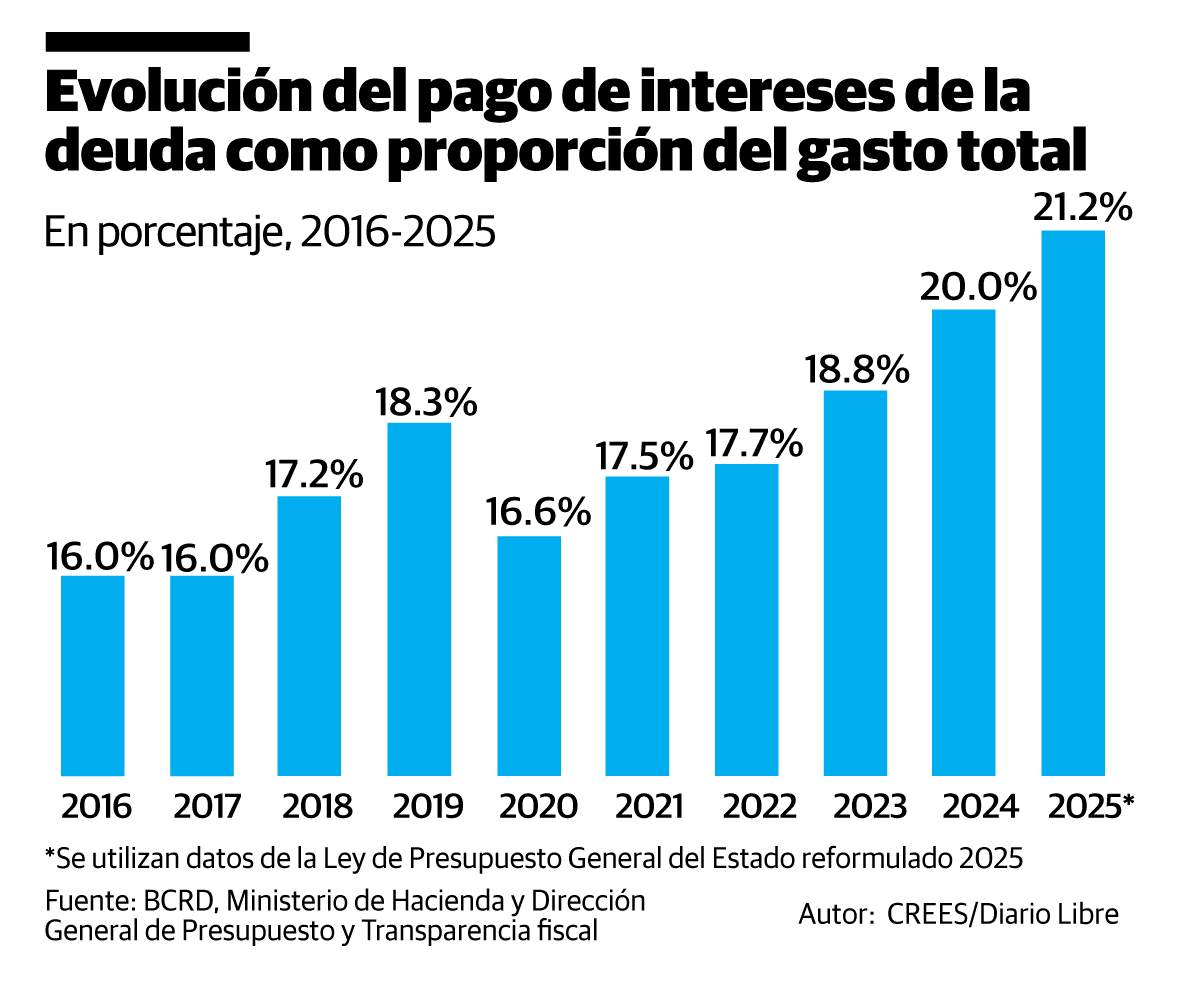

As seen in the graph, the proportion of public spending that is intended to pay interest shows a growing trend in the last 10 years. In 2016, the Dominican Republic allocated 16% of its total spending to paying interest on the public debt.

This proportion has followed a growing trend and, according to the 2025 budget, they would be allocated 330,136.5 million of pesos to this concept, which represents 21.2% of the public spending budgeted.

It is essential to understand that this payment of 330,136.5 million of pesos only covers interest and does not imply amortization of the debt. This means that these funds are not intended to reduce the principal amount of the public debt.

This implies that an increasing proportion of spending covers bond yields and the interest on debt loans that have been taken out to cover fiscal deficits previous.

When looking at the graph, it is necessary to take into account that in the years 2018 and 2019 The proportion of interest expenses increased due to a reduction in the growth rate of total expenses. That is, interest commitments continued to increase at a rate higher than spending. In 2020 the opposite happens, given the increase in total expenditure, the proportion of interest payments is reduced, but the expenditure was higher than in 2019.

He growing debt public means that each year a greater proportion of spending must be allocated to the payment of interest, an amount that is covered with the income collected from citizens and with the same indebtedness because, as is known, money is fungible.

__________

A collaboration of the Regional Center for Sustainable Economic Strategies (Do you believe).