Each election in Colombia has a cost that is not always measured in pesos, but in inequality and while the way in which political campaigns are financed may seem like a matter foreign to the citizen’s pocket, but in reality it has a direct impact on what each Colombian pays in taxes.

This is according to an analysis by the Fiscal and Equity Studies Group (GEFE) of the National University, which maintains that the tax system ends up being one of the most affected by the candidates’ dependence on private money.

You may be interested in: Bioeconomy: the new growth front from which Colombia has not yet taken off

Jairo Orlando Villabona, former director of Dian and director of this study group, explained that when a politician seeks to reach the Presidency, Congress or even a mayor’s office, he needs millions to finance advertising, transportation, logistics and work equipment and that this money, in most cases, does not come from of ordinary citizens, but of business groups or sectors with particular interests.

“Let’s be clear, no one gives billions for the love of democracy. That is not a donation, it is an investment and every investment expects a return. That is where the problems begin for the tax system, because those who finance campaigns end up collecting money later in the form of legal benefits, exemptions or contracts,” said Villabona.

The GEFE group warns that it is necessary to better control the financing of political campaigns.

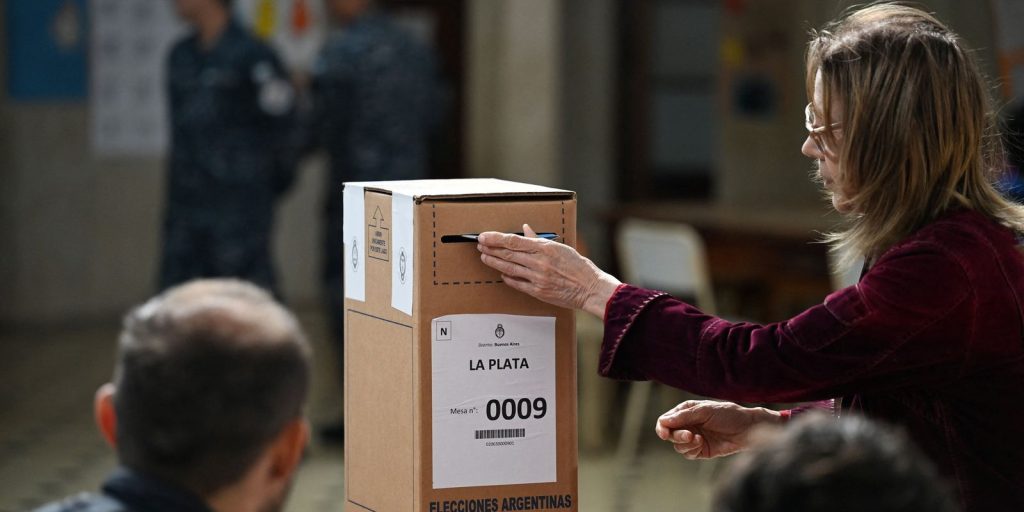

Image from ChatGPT

Simply put, in practice this can be understood as that while a fewIf they manage to pay less taxes or access exemptions, the rest of the taxpayers assume a greater tax burden to compensate for the gaps.

The fiscal effects of the policy

Based on this, the GEFE identifies five mechanisms through which private electoral financing distorts tax justice. First, it encourages tax evasion, since those who finance campaigns often try to recover their contributions by reducing their tax obligations or using avoidance schemes.

Also read: The effects for Petro, his relatives and Benedetti of entering the Clinton List

“Second, it promotes selective tax benefits, as large donors push for exemptions or preferential treatment that end up unbalancing the tax structure. Third, when evaders are connected to political power, investigations and sanctions are slowed down or diluted, weakening the authority of the DIAN and favoring impunity,” they added.

The fourth effect is the political use of public resources; since part of the money raised ends up in contracts or appointments that pay for campaign favors, instead of going to education, health or infrastructure.

The GEFE group warns that it is necessary to better control the financing of political campaigns.

Image from ChatGPT

And the fifth, perhaps the most profound, is citizen distrust, given that when People perceive that the big ones don’t pay, the small ones stop complying and the logic that grows is that “if the powerful don’t pay taxes, why should I?”

A captured tax system

The result, GEFE concludes, is a fragmented and unequal tax system, where large financiers influence both the rules and the distribution of public spending. In economic terms, this reduces the potential for state investment and deteriorates competitiveness, because companies without political backing must assume a higher tax burden than their influential competitors.

Check here: ‘They are taking away the promise of value from Bre-B’

This is why researchers propose strengthening public financing of campaigns as a structural measure to prevent candidates from coming to power with “political debts,” highlighting that with clear rules, citizen control and transparency in the use of resources, the State could shield fiscal independence and guarantee that taxes are equal for everyone.

In the words of the report, “private financing of politics not only erodes democracy, but also tax justice” and marks a starting point from which citizens must think about who they give their vote to and for control organizations it becomes a reference to improve oversight.

DANIEL HERNÁNDEZ NARANJO

Portfolio Journalist