“Revolut is the first independent digital bank to directly apply for and successfully complete the entire licensing and approval process from scratch in the country,” the firm reported.

It will now be able to serve clients who signed up on its waiting list since last year, a priority launch according to its 2024 income statement.

We are very grateful to the authorities for this vote of confidence and their commitment to promoting competition in the industry. We are confident that our offer will benefit millions of people across the country.

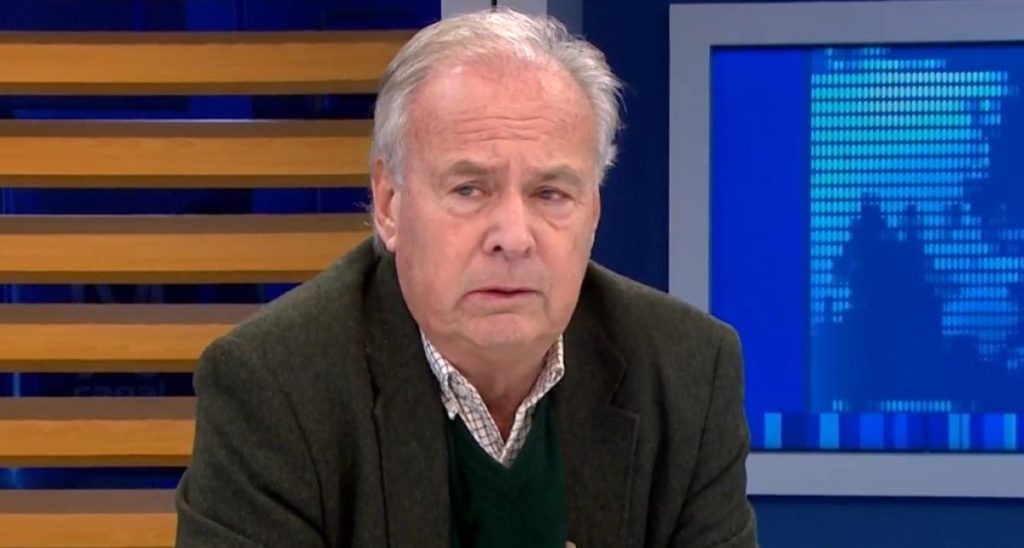

Juan Miguel Guerra, CEO of Revolut Bank.

The firm has not yet revealed which products it will begin operations with, although it promises innovative digital solutions.

In 2015, Revolut launched in the UK offering currency transfer and exchange services. Currently, the firm has served more than 65 million clients globally.

In 2024, Revolut’s revenue grew 72% to $4 billion, driven by its customer base and product usage.

Revolut is seeking a banking license in Colombia and is in the process of acquiring a bank in Argentina. The firm seeks to be a key player in the Mexican financial sector by providing an innovative, complete, elegant and secure digital alternative to traditional banks.