The transaction reached a demand for $974,963 million, of which $350,000 million was awarded. The transaction was carried out through a Dutch auction and had fixed rate references for 2 and 4 years according to market demand, which reached 2.8 times.

Read: Credit card: myths and truths

This placement represents a milestone for the Bank as it is its first sustainable issue in Colombia and the largest that has been made in the country so far in 2025. With this transaction, Santander Colombia strengthens its financial structure, diversifies its funding sources and offers the market a safe, competitive and purposeful investment alternative, in line with its global commitment to achieve zero net emissions in 2050.

The resources obtained will be allocated to finance projects with tangible impact, such as sustainable mobility, financial inclusion, energy transition and business growth with an environmental focus and social, contributing to a greener and more competitive economy.

“With this issuance of sustainable bonds we reaffirm our confidence in the potential of the Colombian economy and its capital market. Sustainability is at the center of our strategy and we firmly believe that banking can be an engine of social and environmental transformation. This result demonstrates the confidence of investors in our management and in the solidity of the bank,” said Martha Woodcock, president of Banco Santander Colombia.

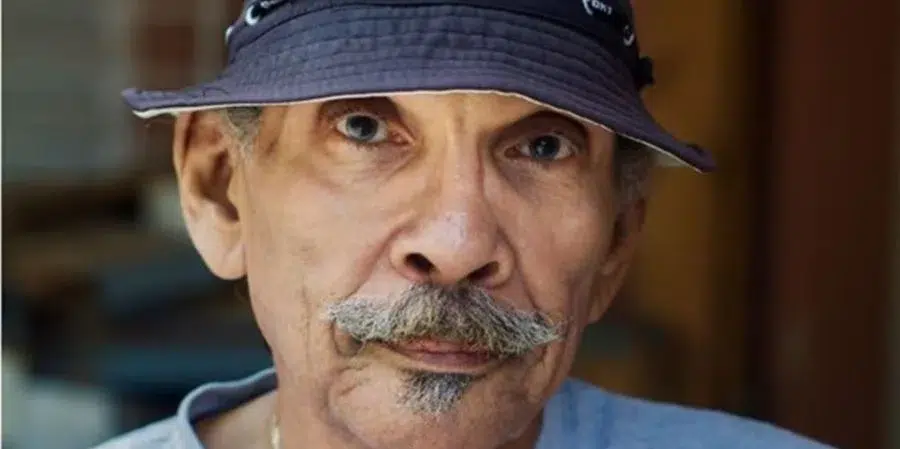

Martha Isabel Woodcock

Milton Díaz / CEET

So far in 2025, The market has registered 27 placements by seven issuing entities, for a total of $1.7 trillion, of which more than $304,000 million correspond to sustainable bonds.

See also: At the end of August, $157.4 billion were disbursed through the Credit Pact